The Power of Public Finance for the Future we Want

Lavinia Steinfort

STATE OF POWER 2019

8 de enero de 2019

It may not be a new idea, but the speed with which the Green New Deal has gained traction in the US is remarkable. Potential presidential candidates are already embracing the call and it’s firmly on the agenda for the new Congress, with 40 Democratic members demanding a firm plan be drawn up.

But what is remarkable is not its popular resonance but the growing political acknowledgement that the government has the power to create the necessary trillions of dollars to not only address the climate crisis but also tackle inequality and transform the economy.

It is hard to overstate the significance of this. Before the 2008 financial crisis, the mantra was that there is no alternative (TINA) to rising inequality, corporate greed and environmental destruction. After 2008, the story became that there is no more public money to pay for the alternative so we must rely on private finance.

The Green New Deal turns that on its head. As its most famous spokesperson, newly elected Congresswoman Alexandria Ocasio Cortez says, the framework has the potential to replicate ‘the Great Society, the moon shot, the civil rights movement of our generation’.

The Costs of Private Finance

The assumption that private finance is the only way to advance social and environmental policy dominates discussions on how to implement the Paris Agreement and the Sustainable Development Goals (SDGs). They frequently ignore how private finance facilitates the extraction of wealth from the public sector to the rich.

A 2018 study that re-examines data from the International Monetary Fund (IMF) on global tax evasion by multinational corporations (MNCs), for example, calculates losses to the public sector to be around US$650 billion, disproportionately hitting people in poor (and plundered) countries.

Another study suggests that from 1995 to 2015 the City of London cost the UK population £4.5 trillion in resources, skills and investments that benefited the financial sector rather than going to society’s more productive activities, as well as the vast wealth that evaporated to the wealthiest in the 2008 financial crisis.

The current ‘yellow vests’ protests in France is another example where people have in part taken to the streets against a so-called ‘ecotax’ because the Macron government was trying to make its population – rather than the polluters – pay for climate change. This happened after it transferred €14 billion from the poor to the rich and another €41 billion to French companies, including MNCs.

When it is deployed – even for productive or progressive purposes – private finance often ends up being more expensive. The UK National Audit Office calculated that when public projects – for example, the building of schools – are privately financed it is 40 per cent more expensive than using public financing.

This is because of the profits that the private investors and shareholders demand; the accounting rules that hide the real costs of private finance until they show up as debt at the end of a project; and the interest rates for borrowing, averaging 7–8 per cent for the private sector and only 3–4 per cent for governments.

A study of 835 cases of public services around the world … has shown that privatised corporations don’t bring better quality of service, lower prices and more investments.

Decades of intellectual efforts have tried to make us believe that the public is dependent on private finance and that there are very few public banks left to finance public services and infrastructure, even though these have proven essential to redistribute wealth more evenly across populations.

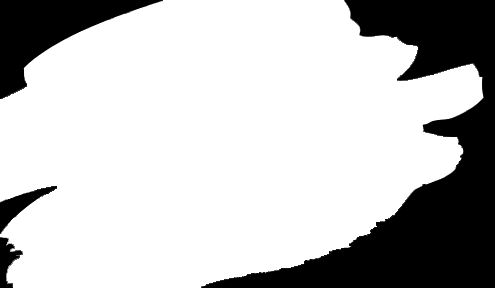

Figures produced by the World Bank and the Organisation for Economic Co-operation and Development (OECD) misrepresent the value of public finance by pretending that public banks have only US$2–5 trillion in assets. With the many trillions that are needed to finance the climate infrastructure needed to combat the climate crisis and bring about the energy transition, this amount would be a drop in the ocean.

However, research undertaken by Thomas Marois of the School of Oriental and African Studies (SOAS) at the University of London, shows that there are worldwide 693 public banks which own assets worth US$37.72 trillion.

This public money is urgently needed to directly finance the fight against adverse climate change and for democratic, socially-just and renewable energy systems. Most governments, however, limit themselves to incentivising private companies to invest in the transition to renewable energy by supporting privatisation and Public–Private Partnerships (PPPs).

Irrespective of countless tax cuts, subsidies and government guarantees, the private sector has shown no significant interest in financing a transition from fossil fuels to renewable energy. With reliance on the private sector, investments in renewables even dropped by 7 per cent in 2017, according to the International Energy Agency. This trend is likely to continue as long as we depend on private finance and market mechanisms.

By contrast, public investment can be made in public systems and services – and with better social and environmental results. A study of 835 cases of public services around the world that either ended privatisation or provided a new public service alternative – of which 311 have been in the energy sector – has shown that privatised corporations don’t bring better quality of service, lower prices and more investments.

Reclaimed, re-municipalised public services more often perform better, proving that, working together, local authorities, workers and communities are much better equipped than any for-profit company to provide quality services for all.

Pillars of Financial Transformation

We can draw four conclusions from these insights. First, the resources are there but are being expropriated and wasted by a very small and very privileged corporate minority. Second, private finance is much more expensive than public finance to pay for public services and infrastructure. Third, despite privatisation, there is still a considerable volume of public finance available in the form of public banks. Fourth, as long as public finance is mobilised for private profits, a just transition towards energy democracy will fail.

So, if we know what we are up against and what we need to fight the climate crisis, how do we envisage finance and money systems that make sure we get there?

Our vision for transforming money and finance rests on two pillars. The first is a politics of finance for the 99 per cent in which public and democratically accountable finance is used to invest in water, health care and education as well as ecologically sound industries.

The second is a politics of public money that encourages governments to use their democratic power to spend money directly in the real economy. Only this will liberate society from the shackles of debt and financialisation. These new politics can give hope as they provide a base for fleshing out radical but viable proposals and practices of public finance for the future we want.

The following real-world alternatives that have withstood neoliberalism from Costa Rica and India to Germany and the US, demonstrate that we can fundamentally transform money and finance so that they foster collective well-being.

Finance for the 99 Per Cent

Kerala, a state in southwest India with over 31 million inhabitants, shows how a web of more than 11,000 cooperatives, combined with high unionisation, public finance and state support, can succeed in fostering strong human development.

Kerala’s state-wide Kudumbashree (meaning ‘prosperity for the family’) programme, which has been running for 20 years, is impressive: 4.3 million economically marginalised women participate in this programme, making up nearly 60 per cent of Kerala’s households.

These women are organised in neighbourhood collectives that are active in a variety of sectors, from construction and transport to textiles and handicrafts to agro-processing and farming. Its farming sector, in which 320,000 women earn a livelihood, is especially inspiring. Working in small neighbourhood collectives, women choose a piece of land and receive low-interest loans, farm machinery, subsidised seeds, and also training and technical support.

This helps them to cultivate rice, fruit and vegetables to feed their families and to sell any surplus in the village markets. This has created 10,000 expert women farmers who are now helping at least five other Indian states to replicate the programme. Ethiopia and South Africa are also in touch with Kerala’s state government to learn from this farming model.

The strong driving force behind Kerala’s social solidarity economy is the organising power of the Left Democratic Front (LDF), a coalition of various left-wing parties – in and out of power – as well as a flourishing network of people’s movements. The LDF, which is currently in government has another ambitious and more recent project to set up a state-wide Co-operative Bank in order to overcome fiscal restraints imposed by Modi central government and to strengthen Kerala’s existing 980 co-operative banks and its 1647 agricultural co-operative credit societies. Together they have deposits of more than US$1billion.

Government involvement can, of course, be problematic, as states can also act very undemocratically, if not in an outright authoritarian manner. In other words, public ownership is no guarantee of democracy. In terms of finance, and instead of top-down government, there is a need for a new generation of public and deeply democratic banks.

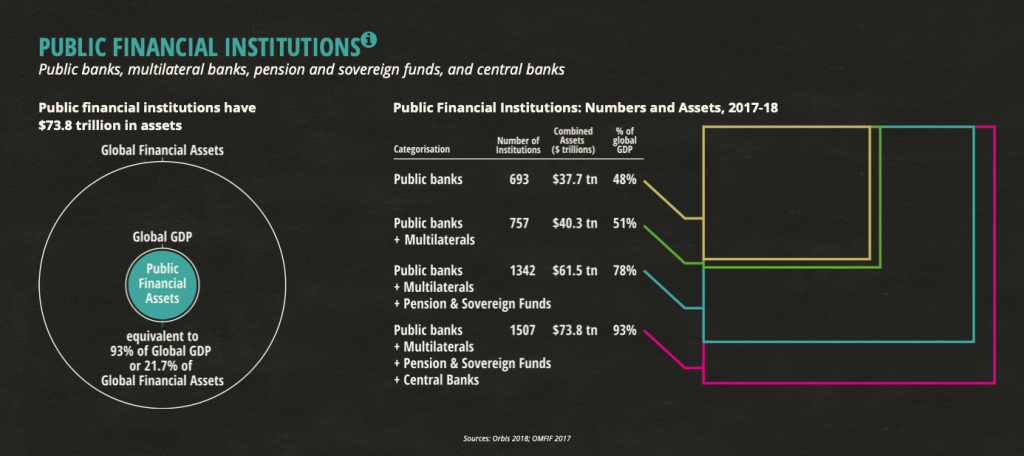

Here we can learn from Costa Rica’s Banco Popular. This bank, which is owned by 1.2 million Costa Rican workers – roughly 20 per cent of the population – is possibly the world’s most democratic bank, with the Assembly of Workers as its highest governing body, in which 290 workers represent 10 different socio-economic sectors.

…examples of co-operative and municipal banking practices provide a way to understand how these principles – such as a binding mandate, the involvement of a variety of stakeholders, providing different channels for popular participation – can facilitate democratic public banking.

It lives up to its mission of serving the social and sustainable welfare of the Costa Rican people by effectively financing co-operatives and groups who tend to face financial exclusion, such as workers, peasants and small and medium-sized enterprises (SMEs). To guarantee this, a quarter of the profits go to special funds to meet the needs of those who would not otherwise have access to the banking system.

Its banking decisions are further guided by principles of gender equity, accessibility and environmental responsibility. Banco Popular works together with the regional energy co-operative COOPELESCA, one of four that successfully electrified the rural parts of the country.

With a low-cost loan, COOPELESCA fully converted to LED lighting and by 2015 the co-operative offset its carbon footprint through its own renewable energy sources and additional environmental actions. The worker-owned bank also helped COOPELESCA to buy exhausted land to preserve soil, biodiversity and water resources.

There is also much to learn from the German saving banks, or Sparkassen. The assets of these 400 local saving banks are nobody’s property. The banks are independent from local authorities, which means that they cannot be privatised or have their profits diverted for other purposes.

Each bank’s board is key to its effectiveness, as it is made up of municipal representatives and other local stakeholders whose duty is to fulfil its binding mandate, which is to stimulate savings, promote financial inclusion and lend to SMEs.

These examples of co-operative and municipal banking practices provide a way to understand how these principles – such as a binding mandate, the involvement of a variety of stakeholders, providing different channels for popular participation – can facilitate democratic public banking.

In Belgium, the ‘Belfius is ours’ platform is looking into these examples in its campaign to democratise Belfius, a privatised bank that was formerly known as Dexia, which was nationalised with its second bail-out in 2011. According to the platform’s founders, Frank Vanaerschot and Aline Fares, to democratise Belfius means that it would effectively serve society, which can happen only through a real society-wide discussion about the bank’s new public mandate as well as its ownership and governance structures.

Procurement is another source of revenue that can transform local economies, especially since public procurement accounts for 15 to 20 per cent of global GDP. The anchor institution strategy, developed by the US-based Democracy Collaborative, creatively expands the potential of procurement through working with anchor institutions, such as hospitals and universities – because they are asset- and capital-rich and locally rooted – to maximise their social contribution through spending, employing and investing locally.

This strategy captures, circulates and builds community wealth. In the US City of Cleveland, it has resulted in the Evergreen Cooperative network, consisting of one of the larger urban greenhouses in the country, a co-operative that installs solar panels and does retrofitting, and a large green laundry company that recently won contracts from Cleveland Clinic, one of the city’s anchor institutions.

The strategy was also picked up by Preston in the UK. In 2013, seven anchor institutions (including a university, two colleges and the Preston City Council) joined forces to spend £38 million in the city and £292 million in county of Lancashire, where Preston is located. By 2017, new contracts covered school meals to big construction projects, with funds growing to £111 million for the city and £486 million for the region.

Politics of Public Money

These real-world examples show that we can use transformative state funding, banking and procurement strategies to build strong human development and community wealth from the ground up. Yet, with a global, debt-driven financial system, we need to ask where the money comes from since most new money is issued by commercial banks in the form of private and often high-interest loans, which perpetuates the cycle of reckless economic growth.

This type of money can be better understood as finance, as it is always based on creating debt and indebting people and entire populations. Even the IMF and the Bank of England now acknowledge that this is how new money is created. That most of our money is based on debt is not a given, it’s a political situation that people and political will can change.

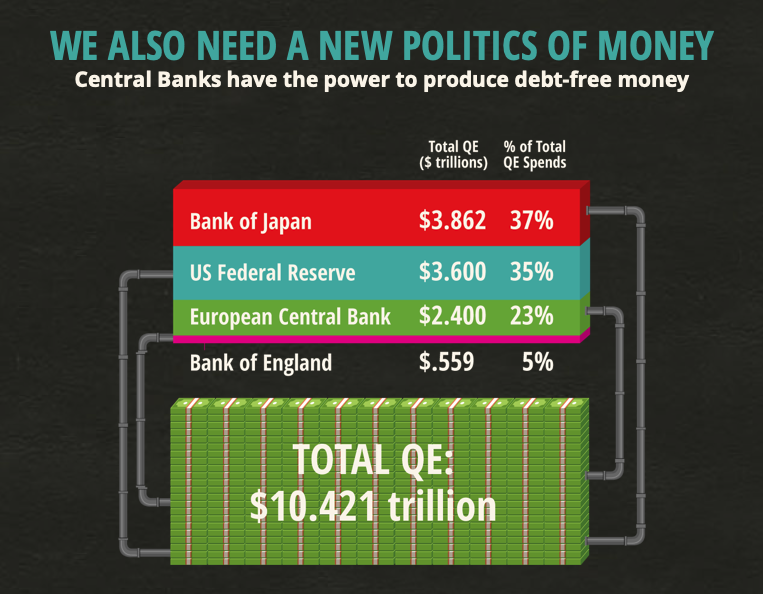

In the neoliberal era, as central banks in many rich countries became apparently independent of government, their primary duty was to guarantee price stability and limit inflation by setting interest rates and producing cash (notes and coins). However, governments’ continued power to issue debt-free money was shown by the €2.5 trillion that the European Central Bank (ECB) created and the US$3.5 trillion that the Federal Reserve issued after the 2008 financial crisis, a process also known as Quantitative Easing.

Although these colossal sums of money should have been spent on fighting ecological collapse, adverse climate change and massive inequality, very little of it reached the productive economy as it was predominantly used to buy up corporate and government bonds. The underlying approach remained tied to trickle-down economics, believing that buying bonds would in turn push up share prices resulting in short-term spending and long-term investing in which everyone would prosper.

This obviously never happened as only the wealthy own shares and they know they can make more quick money through the financial sector than more productive sectors.

Governments, therefore, still have the power to spend money rather than borrowing it, but the way they have used it has led to more and not less concentration of wealth. The 2008 global financial crisis showed that financial losses are always socialised on the backs of ordinary people through bank bailouts and austerity measures.

Given that the public is ultimately liable, this illustrates that even credit or debt-driven money issued by commercial banks should be considered a public good and therefore should be in public hands and democratically controlled.

A new public money system could channel grants to foster collective well-being.

It will take a ‘politics of public money’, as opposed to a politics of privatised finance, to stop the growth juggernaut. This can be done only by reasserting the powers to create new money in order to fundamentally democratise our money systems by spending – instead of borrowing – it. And it should be spent, not in the financial markets but to address the many great challenges of our time.

With amassed counterpower, we can reclaim the state and create a new monetary model. To give an example of what such a model could look like, Mary Mellor, Emeritus Professor at Northumbria University, argues in her book Debt or Democracy that a new model could allow people to democratically and collectively decide the amount of public money that should be created to pay for a basic income and universal basic services.

Any publicly created money that turns out to be superfluous would be retrieved through taxes in order to keep inflation in check. But as even the trillions created by central banks after the 2008 crisis did not result in inflation, the fear of hyperinflation seems largely unsubstantiated. Moreover, with so many new goods and services needed to restore our ecosystems, rebuild public services and create meaningful labour, the new money can certainly be put to very good use.

While this proposal may sound too radical to many politicians, the push for creating new public money in the people’s interest is gaining significant momentum. The Green New Deal, cited earlier, is one example. It has galvanised public support for massive public investment in order to fight climate change, powered by publicly created money and a new public infrastructure bank. A new public money system could channel grants to foster collective well-being.

Linking our struggles against ecological collapse and all forms of exploitation to these efforts to build radically just money and finance systems is vital to transform our economies. We need to join forces for a new politics of public money and finance for the 99 per cent, to build the organisational strength such as that already shown in Kerala, of progressive unionisation, public finance and state support for thriving co-operative networks.

We must demand and develop policies for democratic banking that include a binding public mandate and a diverse range of local stakeholders on its board. We can transform public procurement and institutions’ spending, investment and employment practices to build community wealth. In this way, we can ultimately reclaim our money systems so that they are public and democratically controlled, used to build life-sustaining democratic economies.

This article draws on research from TNI’s forthcoming book ‘Public Finance for the Future We Want’, which highlights the real-world practices and proposals that can transform our money and finance systems for the 99%. The book argues for public money, democratic banking and co-operative networks to make the case for life-sustaining economic democracies.