Big Finance

The key players

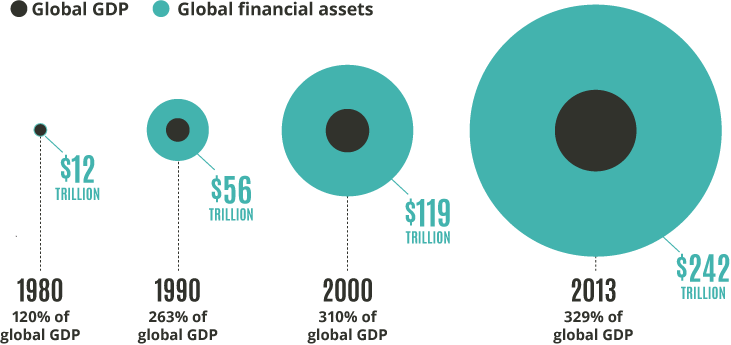

Global financial assets

Sources: (Deutsche Bank, 2013; TNI, 2018)

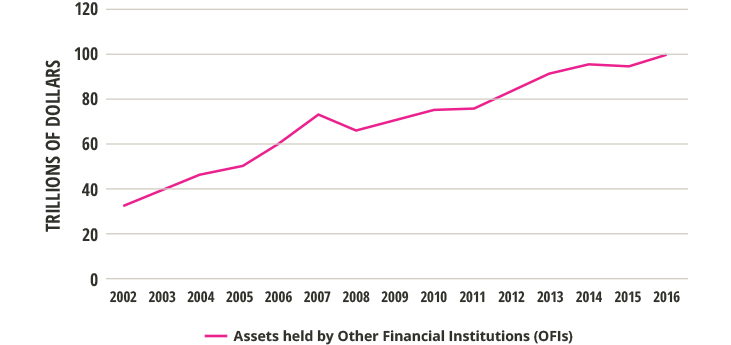

Source: (FSB, 2018)

Shadow Banking

Shadow banking are financial institutions which lie outside of the formal banking regulatory system despite performing similar functions to banks, such as providing credit. Due to this, they raise and lend money more easily, but with considerably more risk.

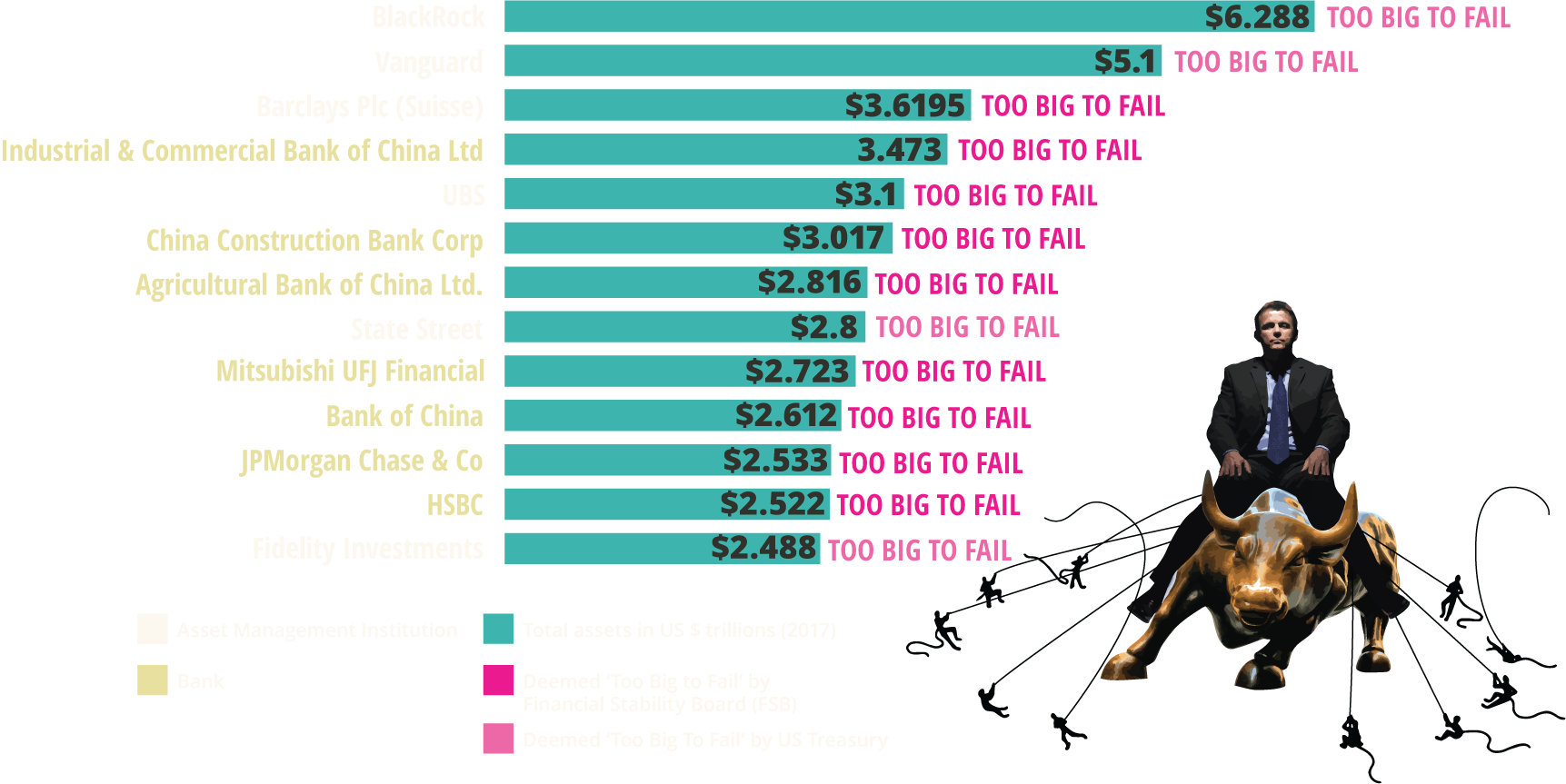

TOP 13 FINANCIAL GIANTS

Source: (FSB, 2018, Phillips, 2018)

The traditional view of commercial banks is that they are financial intermediaries: taking in savings, issuing deposits, and then channel these savings into loans. Yet, in reality commercial banks are not financial intermediaries. They are money creating machines. Each time they give out a loan they are injecting new money into the system. When these loans are paid back, this money is destroyed. In fact, almost all of the money that circulates in the system is not cash: the notes and coins in our wallets. 97% of money are bank deposits, which have been created by banks when they give out loans.

LINK | LINK

EXAMPLES: JP Morgan | Barclays | Credit Suisse

CASE STUDY: DEUTSCHE BANK IMPUNITY

The world’s largest banks are widely considered by policy makers, economists and politicians to be too big to fail. This privileged position gives banks an implicit impunity or subsidy for their riskier and often fraudulent behavior, reflected in how they are treated when they break the law. Throughout the 2000s, for example, Deutsche Bank had lended money to mortgage borrowers it knew couldn’t repay. It then sold these junk bonds on to other investors pretending they were decent investments. This type of activity helped to crash the US housing market in 2008 and subsequently the global economy. If a person or a smaller corporation had done this, they would be imprisoned and put out of business. But with Deutsche Bank, they managed to negotiate their fine down from the original $14 billion amount to $7.2 billion, under the threat that it might bring down the global financial system.

Read more

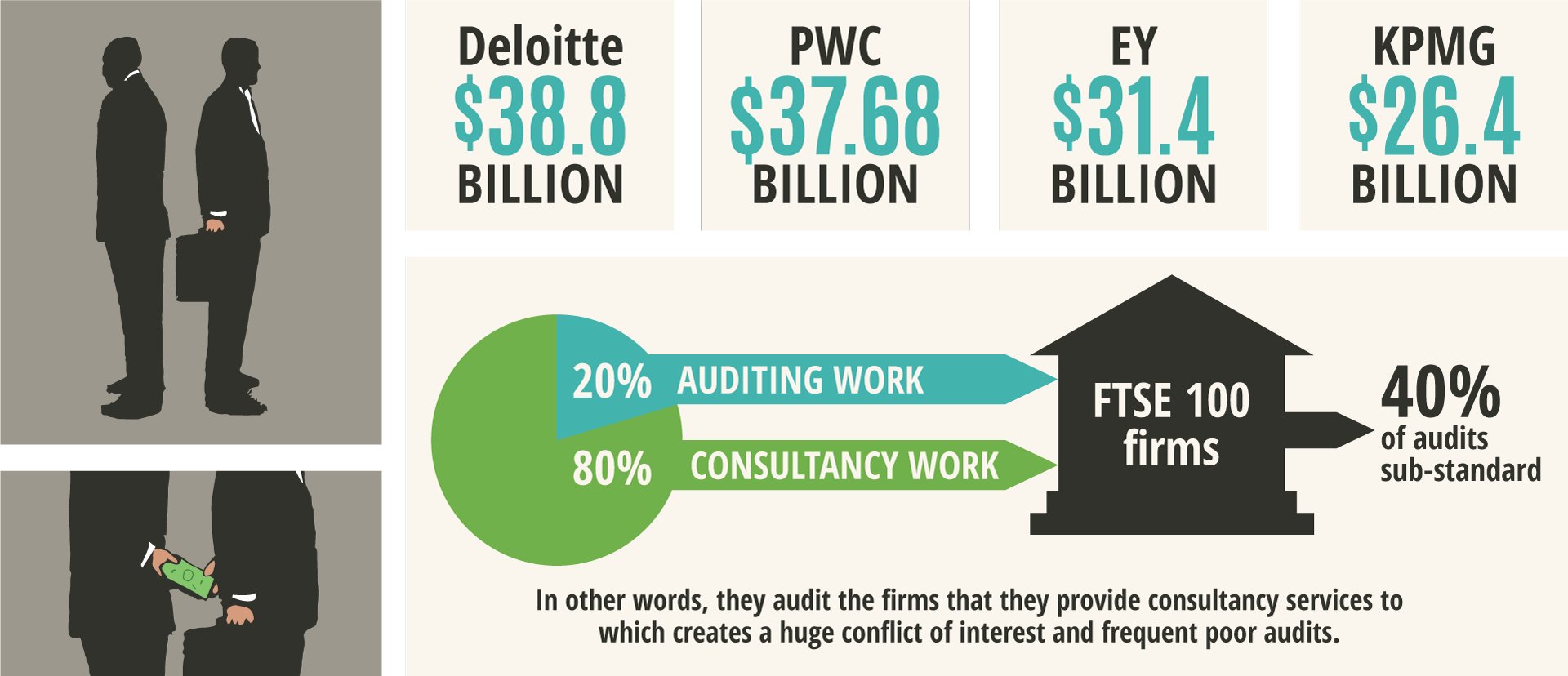

EXAMPLES: Deloitte | PWC | EY | KPMG

CASE STUDY: DELOITTE AND BANKIA

In 2011, Deloitte audited the profits of the Spanish Bank, Bankia, preparing and signing off reported profits of €300 million. The following year the bank was nationalised in a bailout program. But when the government started looking through Bankia’s accounts after the sale, it realised that Delloitte had massively hyped up the profits of the bank. In 2011, Bankia hadn’t made €300 million. It had actually lost €4.3 billion! For this fraud, Deloitte walked away with only a minor €12 million fine, while the taxpayer lost €16 billion.

EXAMPLES – TOP 3 PENSION FUNDS

1. Government Pension Investment Japan $1,237,636

2. Government Pension Fund Norway $893,088

3. Federal Retirement Thrift U.S. $485,575

A common defence of global financial power is that without financial markets creating sophisticated financial products generating high returns, people would not have a pension and an income in retirement. The idea is that the money driving financial markets is not coming from a wealthy elite, but rather, from the savings of ordinary workers in the form of pensions. This is partly true but it hides how pension wealth is still very unequally distributed as well as how the risk of paying for retirement has shifted from corporations to workers over the last decade. In the US a third of Americans have no money put aside at all - a similar figure for the UK. And even for those, who have pensions, they are now largely “defined contribution” plans, where income is not guaranteed and instead depends on how well financial markets are doing. In other words, capital benefits while workers lose out. Still pension funds do highlight how people can and could influence financial markets and ultimately change where money is invested.

Read more in Owen Davis’ The Shareholder Revolution

TOP 3 TOO BIG TO FAIL INSURERS:

Axa S.A

Allianz SE

MetLife Inc

CASE STUDY: INSURANCE AND THE 2008 CRISIS

Insurance companies were critical actors in the financial crisis of 2008. In the run-up to the crisis, they had issued $45 trillion of Credit Default Swaps (CDS) to banks, a form of insurance to cover them if a loan turns bad and can’t be repaid. That's more than the money invested in the U.S. stock market, mortgages, and U.S. Treasury combined. Inevitably, when the crisis came, and defaults rose, the insurance companies couldn’t pay out and risked going bust. In the case of the US, in 2008 the Federal reserve had to fork out $182.3 billion to save insurance company AIG.

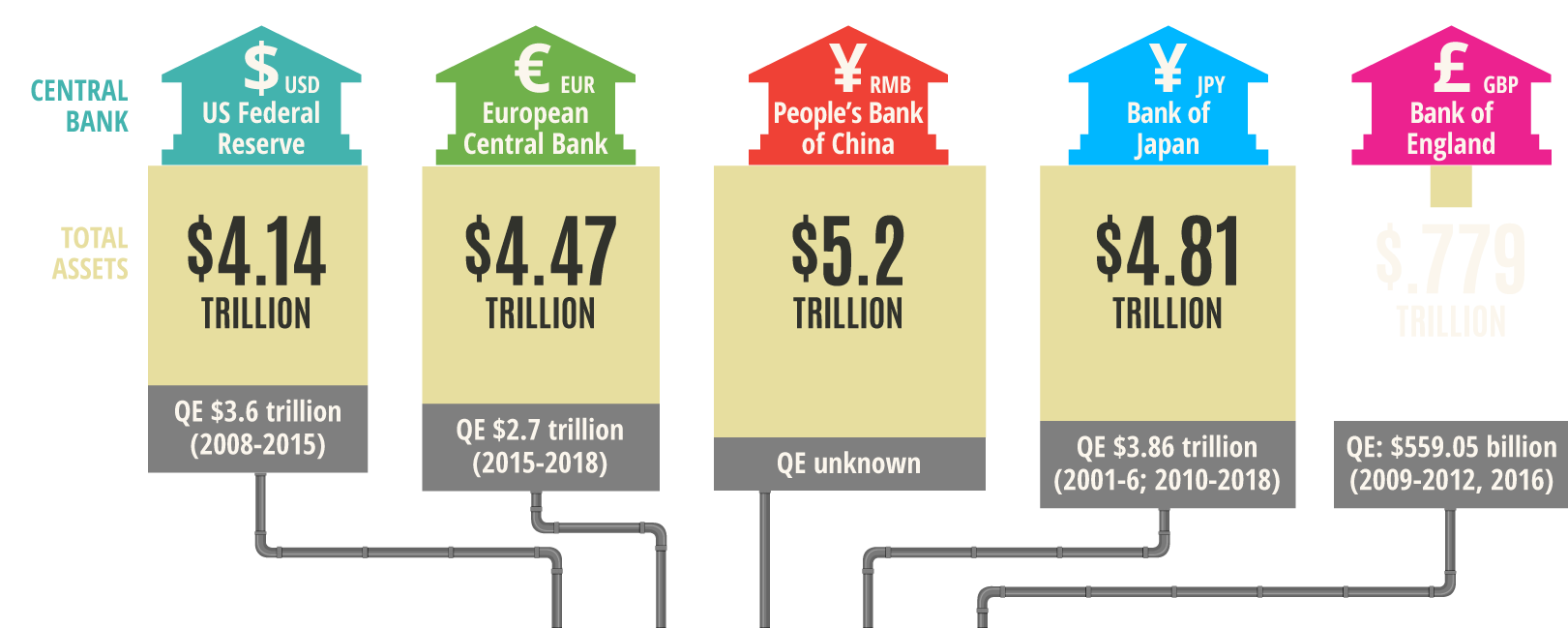

EXAMPLES: US Federal Reserve | European Central Bank | Peoples’ Bank of China

CASE STUDY: CENTRAL BANKS AND QUANTITATIVE EASING

In the wake of the financial crisis, central banks around the world dropped interest rates to almost 0% in order to stimulate the economy. They have remained at historically unprecedented low rates ever since. When it became clear low interest rates was not going to be enough to kickstart the economy, central banks unconventionally printed vast quantities of new money and pumped it into the banking sector: what is known as Quantitative Easing. In total, the top four central banks created more than $14 trillion in new money at a time where most governments cut spending on essential public services arguing that there isn’t enough money. QE has failed to increase lending to the real economy and has instead raised asset prices and increased wealth inequality. It has not been used for a real transition to a green economy

Read more: Ann Pettifor on The Latent, Unused Power of Citizens and the Production of Public Collateral

There are two different types of investment funds:

Private Equity firms are money managers who take over the actual management of the businesses they buy and change the day to day running of the firm to maximise profits and returns. They are famous for a smash-and-grab style of investing, maximising revenue flows by laying off workers and evading tax.

Example: Kohlberg Kravis Roberts (KKR).

Index funds are called passive as they don’t require actual investors deciding where money should be invested. Instead it is all done by tracking an index, for example the S&P500, the index of the top 500 companies in the US. An index fund will just buy shares of these top 500 companies. When different companies move into and out of the index, the fund will simply sell or buy shares to keep it in line with the S&P500. Index funds have become very popular since the financial crisis, as they have lower fees for investors compared to other active funds because the work is automated. And they tend to perform as well: it is estimated that 50 to 80% of mutual funds fail to beat their benchmark indexes in most years.

EXAMPLE: Vanguard Total World Stock Index Investor Shares

CASE STUDY: INDEX FUNDS AND THE ACCUMULATION OF EXTRAORDINARY SHAREHOLDER POWER

Since the financial crisis, there has been a seismic shift from active to passive management funds. From 2007 to 2016, actively managed funds have recorded outflows of roughly US$1,200 billion while US$1,400 billion has flooded into index funds. What does this shift mean? For some it represents the democratisation of finance: it is now much easier for the average person to put their money in an index fund without incurring the high fees of active management funds. Yet, the rise of index funds is also leading to a concentration of ownership of the world’s biggest corporations. Blackrock, Vanguard and State Street, together, have become the largest shareholder in 40% of all publicly listed firms in the United States. In 2015, these 1,600 American firms had combined revenues of about US$9.1 trillion, a market capitalisation of more than US$17 trillion, employing more than 23.5 million people. This power is undoubtedly used. As William McNabb, the previous Chairman and CEO of Vanguard stated: ‘In the past, some have mistakenly assumed that our predominantly passive management style suggests a passive attitude with respect to corporate governance. Nothing could be further from the truth.’

Read more on the Big Three

EXAMPLES: • Tianhong Yu’e Bao of Ant Financial Services Group

• JPMorgan’s US government money market fund

CASE STUDY: MMFs ROLE IN 2008 CRISIS

Until 2008, only three money funds had broken the buck in their 37-year history. Yet, the collapse in share price in MMFs was at the heart of the financial crisis in 2008. The day after Lehman Brothers collapsed in September 2009, the US’ largest MMF broke the buck. There was a huge outflow of money from these funds by wealthy investors who feared that they would go broke, just like savers fearing a collapsing bank. The prestige of MMFs as a safe place to store your money was shattered. MMFs moreover had played a key role in fueling the crisis as one of the prime shadow banking institutions that helped pump vast sums of money into the US housing market via their purchases of Mortgage Backed Securities.

Since the crisis, new global financial leaders Blackrock and Vanguard have risen in part because of people shifting their money away from MMFs and into passive investment vehicles like index funds and ETFs.

EXAMPLE: Bridgewater Associates

CASE STUDY: HEDGE FUNDS AND OFFSHORE FINANCE

Despite only holding a relatively small share of financial assets, hedge funds pose serious concerns because of both their concentration of wealth and power and the secrecy of their operations. About 60% of global hedge fund assets are legally domiciled in one offshore tax haven - the Cayman Islands - which has underpinned their returns more than their capacity to find the most profitable companies.

Read more

EXAMPLES: BlackRock | Vanguard | Fidelity

CASE STUDY: BLACKROCK RISES ON BACK OF FINANCIAL CRISIS

BlackRock is the largest financial institution in the world and its success is largely down to the pivotal role it played in the US government bailouts of the financial crisis in 2007/8. At a time when the US financial system was collapsing, the Federal Reserve and top Wall Street Executives turned to BlackRock to help assess the value and risks of the balance sheets of failing institutions. BlackRock became the manager of the bailout programs, overseeing the $130 billion bailout of Bear Stearns and AIG; the $5 trillion balance sheets of Fannie Mae and Freddie Mac and 1.2 trillion worth of mortgage-backed securities the New York Fed took on to prevent the collapse of the US housing market. Why did the US government turn to BlackRock for help? Part of the answer is because it had designed an extremely sophisticated computer system of over 5,000 computers running 24 hours a day, called Aladdin. This enabled BlackRock to manage the huge portfolios of the failing banks and insurers.

Top 17 Asset Management Firms

- BlackRock, US

- Vanguard Group, US

- JP Morgan Chase, US

- Allianz SE, Germany

- UBS, Switzerland

- Bank of America Merrill Lynch US

- Barclays plc, UK

- State Street Global Advisors, US

- Fidelity Investments (FMR), US

- Bank of New York Mellon, US

- AXA Group, France

- Capital Group, US

- Goldman Sachs Group, US

- Credit Suisse, Switzerland

- Prudential Financial, US

- Morgan Stanley & Co., US

- Amundi/Crédit Agricole, France

199 directors control $41.1 trillion wealth

G30

The Group of Thirty (G30) is a privately funded international group of 30 top financiers, academics and policy makers, whose aim is to influence policy and discourse in international finance and global politics.

Trilateral Commission

The Trilateral Commission is an unofficial (i.e. not officially overseen by governments) organisation where 375 global elites from 40 countries meet to tackle pressing international issues.

Source: (Phillips, 2018)

OILED BY CENTRAL BANKS

Quantitative Easing

QE is an unconventional monetary policy aimed to stimulate economic activity. Central banks create new money and use this to buy government and corporate bonds from financial markets.

Sources: Investopedia, 2018, FT, 2017/2018, Central Banks, 2018

Key Fact

$14tn of Quantitative Easing made by ECB, Bank of England, Bank of Japan and the Fed. This is enough money to hand out $16,279 to every person in Europe, the UK, Japan and the USA.

AUDITED BY INSIDERS: THE BIG FOUR

Sources: Statista, 2018, FT, 2017