This essay is part of the book Public Finance for the Future We Want, you can find the entire collection of essays .

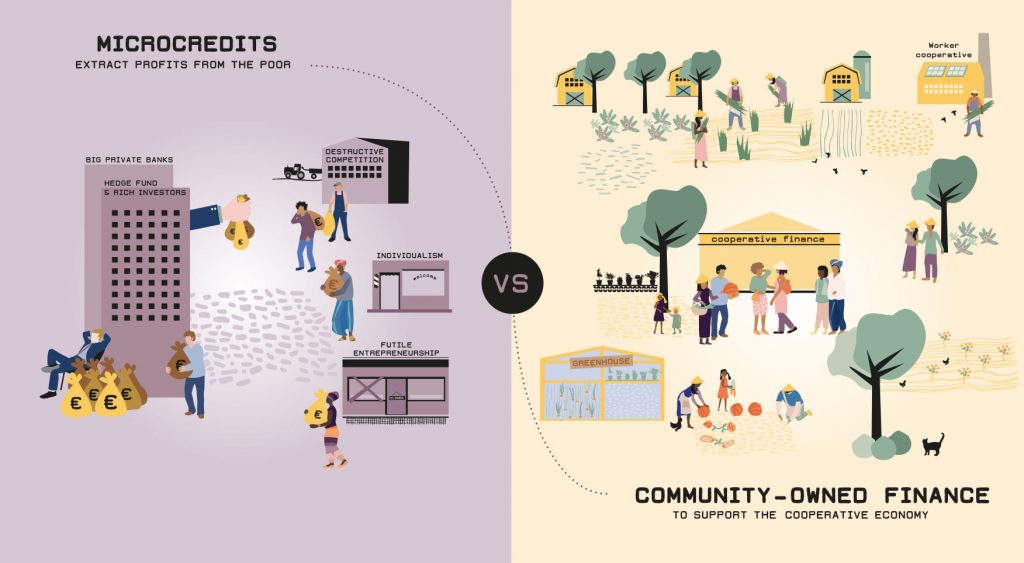

Since the 1980s, the global neoliberal financial model (‘financialization’) has enriched a narrow elite and significantly disadvantaged the global poor.1 The damage done by local versions of this model promoted by the international development community in the Global South is not as widely recognized, however. Local financial neoliberalism is epitomized by the global microcredit model.2 Microcredit was made famous in the 1980s by the US-trained Bangladeshi economist and later Nobel Peace Prize winner Muhammad Yunus, who posited that the provision of small (micro) loans to the poor for the creation of informal enterprises or self-employment ventures would lift them out of poverty. The microcredit model captured the zeitgeist of early neoliberalism and its celebration of individualism, entrepreneurship and self-help. As a way of ‘bringing capitalism down to the poor’ the microcredit model was quickly embraced by the World Bank and the US government and used as a development mantra in the Global South. It did not yield the promised local economic and social results, however. Yet microcredit is still being promoted extensively by international financial institutions to this day. As a progressive alternative, this chapter highlights four non-neoliberal examples from Europe and Asia to show how the countermovement of community-owned and controlled finance can and has successfully encouraged equitable development.

Why local neoliberalism and the micro- credit model failed

With microcredit’s conversion into a for-profit business model in the 1990s under the United States Agency for International Development (USAID) and World Bank tutelage, some of its advocates saw a ‘new world’ of massive poverty reduction and local economic development just over the horizon.3 By the 2010s, however, it had become clear that the microcredit model was no anti-poverty panacea, but a slow-moving disaster for the global poor. The key operational flaw in the commercialized microcredit model is that the most unsustainable enterprises are supported because they prove more lucrative for the microcredit institution. Quick turnover, informal micro- enterprises and self-employment ventures that can afford high interest rates over short periods of time are thus supplied with as much capital as they want. Meanwhile more productive, formal, technology-driven micro, small and medium enterprises (MSMEs) are generally left to wither on the vine. They are riskier and more time-consuming to work with and they need lower interest rates, especially during startup. Many microcredit institutions go even further than this and now simply provide individual consumers with microcredit for consumption purposes.

With its anti-poverty claims increasingly refuted4, the global microcredit industry now appears to serve another purpose entirely: to siphon value up and out of the poorest communities in the Global South and into the hands of the narrow global financial elite that manages, owns, invests in and advises the global microcredit industry.5 The principal beneficiaries of microcredit have thus become its suppliers. The US government has backed its national banks (e.g. Citigroup) and digital payments providers (e.g. Visa, Mastercard) to enable them to make significant profits in the poorest communities of the Global South.6 More worrying, the latest innovations in financial technology – so-called ‘fin-tech’ – are very rapidly expanding this deleterious trend towards ‘accumulation by dispossession’.7

Embracing community-based local financial institutions

Almost completely ignored by the international development community in recent years are local financial systems and institutions that have been successful in promoting sustainable and equitable local economic development. This chapter presents four cases from Europe and Asia to illustrate this.

Northern Italy

After 1945, northern Italy’s famous credit cooperatives (Banche di Credito Cooperativo, BCCs), operating alongside the larger cooperative banks (Banche Popolari, BPs), supported a wave of small enterprises that arose out of the region’s largely destroyed but once very significant military-industrial complex. Over subsequent years, enormous effort also went into diversifying the local economy into new markets, technologies and global value chains. Attention was paid towards redirecting local MSMEs to operate in line with the newly elected communist and socialist regional governments’ ambitions to reform capitalism. At a practical level this involved supporting only enterprises that were able to succeed on the basis of well-paid, unionized and secure employment relations, thus moving beyond the pre-war forms of exploitation that contributed to the rise of Fascism.

The most far-reaching contribution made by northern Italy’s BCCs and BPs, however, was the comprehensive support provided to a variety of non- financial cooperative enterprises. Always a region with a strong cooperative spirit dating back to the mid-1800s, in the post-war period this sector massively expanded and diversified into new areas of technology-driven economic activity and many worker cooperatives became leaders in their field. Particularly important were the linkages created between different types of cooperatives, such as rural-based agricultural cooperatives selling to retail cooperatives in urban areas. Marketing cooperatives also linked private micro- and small enterprises to generate economies of scale. The eventual result was the creation of the world’s leading regional cluster of cooperatives.8 Pointedly, they were on the whole more efficient than their investor-driven counterparts, which clearly contributed to the high levels of productivity and growth registered by the northern regional economies.9

While the wider investor-driven enterprise sector in Italy endured a difficult time during the 1980s and 1990s, northern Italy’s cooperative sector was, in stark contrast, able to flourish as never before.10 Although the BPs struggled to compete against the more aggressive Italian and foreign private banks and were eventually restructured almost to the point of losing their co- operative identity, the smaller and more localized BCCs proved more resilient. One important reason for this was that in 1993 the BCCs were mandated by a new banking law to join one of 15 local federations operating under a national federation (Federcasse). This arrangement allowed for each BCC to reap an important share of the collective economies of scale that

arose from the central provision of a whole range of core services and functions. Being small was not such a disadvantage to the average BCC, but being isolated was. It has also greatly helped the BCC sector that, in return for tax breaks, Italian law mandates that 70 per cent of annual net profit in a BCC must be allocated to its legal reserve, which usefully builds the capital base of the institution. Even though mergers and some closures reduced the actual number of BCCs after the 1980s, the sector managed to increase its market share. By law, a BCC’s assets cannot be appropriated by members seeking to privately profit, so in the event of a liquidation, any remaining assets must be passed to a cooperative support fund (Fondo Sviluppo Spa). This important ‘asset lock’ constraint safeguards against speculation and take-over by an outside investor.

Nonetheless, the financial cooperative sector has had to hold fast to its initial ambitions and hopes. Fearing a collective ethos that downplays the role of the individual entrepreneur, Italy’s succession of right-wing governments and their big business allies have tried to tear down supportive legislation and regulations for the cooperative sector, particularly from 2001 onwards. Most recently, the financial cooperatives have had to make some painful adjustments in order to survive in the aftermath of the global financial crisis of 2008. Many other forms of cooperatives in the northern regions were forced to downsize after demand from Italian and European consumers fell precipitately. Nevertheless, northern Italy’s cooperative sector has managed to maintain and extend its unique regional/local economic model based on the pursuit of higher average living standards, economic democracy and a high level of social justice.11

The Basque region of northern Spain

Spain also provides a number of important examples where cooperative- based local financial systems have produced sustainable local economic development. By far the most important example is that of the famous Mondragón Cooperative Complex (MCC) located in the Basque region of northern Spain. MCC’s origin lies in a small cooperatively managed technical training school established by Don José María Arizmendiarrieta,

a local parish priest. This was followed in 1956 by the opening of the first worker cooperative in Mondragón making stoves for the Spanish market. Raising the initial financial resources to launch this first cooperative was not easy, however, and it became clear that a bank owned by and serving the community was needed.

The result in 1959 was the establishment of the Caja Laboral Popular (CLP, Working People’s Bank), a secondary cooperative bank established by four of the town’s cooperatives. The CLP grew very rapidly. One reason was that savings were quickly generated among the hard-working and thrifty local population, not least because they knew that this would help start up new worker cooperatives in their community marked by unemployment and poverty. In the early 1980s the CLP also began to mobilize savings from across Spain.

Crucially, the CLP established an ‘entrepreneurial division’ – a team of specialists able to assess, establish and fund cooperative ventures. New cooperative projects presented to the CLP were carefully evaluated not only on the basis of their individual economic merits and growth potential, their ‘strategic fit’ as subcontractors within the growing Mondragón cooperative group, but also on their adherence to its core principles of extending industrial democracy, fostering cooperation and providing mutual support. Such careful management and investment of member savings by the CLP ensured that in the first 30 years of operation only a handful of new cooperative projects failed. The CLP also played a crucial local development role by funding the most promising ideas and innovations that emerged from the MCC’s own raft of internationally renowned research and development centres.

In the 1990s a restructuring process forced upon the CLP by the Spanish government saw the repositioning of the bank as semi-independent from the operations of the MCC. The CLP was able to successfully generate savings from across Spain, while its lending activities were extended to establishing other types of businesses. Nonetheless, the CLP’s priority remained to provide all necessary financial, technical and advisory services to existing cooperatives within the MCC. It also established a separate financial vehicle – MCC Investments – that provides low-cost funds to medium to larger cooperatives across Spain.

The cooperative bank’s structure has changed over the years, and the 2008 global financial crisis combined with Spain’s dramatic recession affected the MCC’s operations considerably,12 but the CLP continued to play a major role in ensuring the sustainable development of the Basque region. Indeed, it contributed to turning what was once the poorest region in Spain into its richest, with the average living standards and quality of life among the highest in Europe.13 More specifically, despite huge pressures from conven- tional capitalist enterprises deriving a competitive advantage from using exploitative working practices, the CLP (now known as Laboral Kutxa) has not wilted in its ambitions. It has built the MCC up into a major employer (roughly 75,000 worker-members) while maintaining as much as possible the group’s overall focus on extending democracy into the workplace and promoting its wider economic and social justice goals.

Finally, an important aspect of the MCC experience that cannot go unremarked is its transferability. In spite of many critics arguing that the model is interesting but geographically and culturally specific, several other regions in Spain have prospered using the same cooperative parameters and after building their own version of the CLP. By far the most successful is Cajamar, located in Almeria Province in southern Spain. Now the largest cooperative bank in the country, Cajamar was the driving force behind a local economic development success story: the ‘Almeria Model’. Its success derives from Cajamar’s general support for cooperative enterprises, and for clusters of agro-industrial SMEs assembled in cooperatives in particular. Moreover, as Cajamar’s resources and capacity grew with time, it was able to increasingly provide impetus for social innovation, technology acquisition and transfer, and other forms of progressive social and economic development of benefit to the local community. Cajamar’s role has been described as that of ‘a cooperative bank, (which) in concert with the cooperative movement, was able to construct an economically stable community through sustainable innovation’.14

China

It is under-appreciated that the origin of China’s spectacular rise to economic power beginning in the 1980s came not from foreign direct investment, as many claim, but from urban and rural credit cooperatives (UCCs and RCCs) set up to finance accelerated local economic development.15 UCCs and RCCs were multi-stakeholders financial institutions that were community- owned but largely directed by local governments with an important element of member input. Local government involvement in the UCCs and RCCs, as well as oversight by the Agricultural Bank of China (ABC), gave local people the confidence necessary to deposit their savings in them. While up to 30 per cent of deposits mobilized by the RCCs were transferred to ABC, the remainder was invested regionally to create new jobs and promote economic development. It helped that local government incorporated UCCs’ and RCCs’ operations into local development plans. This meant that they could receive additional funding and other forms of financial and technical support from local governments in order to build enterprises aligned with sustainable development goals. Member involvement also meant that ongoing problems and opportunities at the local level could be passed on to local government officials and acted upon. By far the most decisive factor behind the success of the UCCs and RCCs as a local economic development instrument, however, had to do with the type of enterprises they supported. These were local government-owned and industry-based Township and Village Enterprises (TVEs). Generously equipped with the latest foreign production technologies, with easy access to the port of Hong Kong, the TVEs proliferated rapidly from the early 1980s onwards. By the mid-1990s there were nearly 7.6 million industrial TVEs operating across China.16 Large numbers of high-skill industrial jobs were quickly created, with employment in TVEs peaking in 1996 at around 135 million.17 In addition, local government ownership of TVEs allowed for a significant proportion of their profits to be recycled back into further development of the local economy, through establishing incubator units, business parks, training and vocational education schemes, special development funds, and so on. Social facilities were also supported, particularly in the education, sport and cultural fields.

While the TVEs undoubtedly provided the foundation for China’s economic miracle, the wind turned when the global neoliberal project spread to China in the early 1990s. With capitalism triumphant in the aftermath of the collapse of Eastern Europe’s centrally planned economies, many Chinese policy-makers at the national and local levels began to rethink some aspects of their developmental model and bought into the central neoliberal narrative that local growth would be accelerated if all manner of institutions were privatized and put into the hands of profit-oriented business people. Local governments were encouraged to begin to follow the ‘Wenzhou model’, an overtly neoliberal, and ultimately unsuccessful, local market-driven economic development model pioneered in that city.18

Inevitably, the UCCs and RCCs also came to be seen as ‘out-of-date’ and ‘too interventionist’. Some were also criticized for having run up serious debts. The RCCs and UCCs were therefore put on a path towards privatization. Most UCCs and RCCs were converted into fully private City Commercial Banks and Rural Commercial Banks, respectively. In the process, their original local development goals were stripped away, their successor institutions pursuing financial self-sustainability above all. As a result, the new banks stepped away from supporting TVEs, and began to support a new generation of privately owned SMEs. While the local neoliberal financial model soon disappointed, especially in terms of the growing inequality it generated,19 it nevertheless played its intended part in creating a new capitalist elite in China that supports and legitimizes the Communist Party in governing the country.

Notwithstanding their eventual demise, thanks to their decisive support for the TVE movement in the 1980s and early 1990s, the UCCs and RCCs played a critical role in kick-starting China’s staggeringly successful ‘bottom-up’ episode of economic development and structural transformation. Large numbers of high-skill industrial jobs were created, entirely new export markets were established, and the average citizen also greatly benefited from the reinvestment of the wealth generated by TVEs back into local public projects and social services.

Vietnam

Vietnam reformed in the mid-1980s. Serendipitously, the country rejected microcredit, instead choosing to follow China’s local financial model. As a result, Vietnam established a comprehensive set of financial institutions under national and local government and community-cooperative owner- ship and/or control.

One of the most important of several financial institutions operating successfully at the local level is the People’s Credit Funds (PCFs). The PCFs are commune-based financial cooperatives that were established from 1993 onwards to replace hundreds of credit cooperatives that failed in the 1980s due to weak regulations and a lack of supervision, which led to extensive fraud.20 The inspiration for the PCF model comes from the Caisse populaire system pioneered and successfully used for many years in the province of Quebec in Canada. Established by the State Bank of Vietnam, the country’s central bank, the PCFs now operate under their own cooperative institution, the Cooperative Bank of Vietnam (Coop Bank) established in 2013. By 2017 a total of 1,186 PCFs were in operation involving two million members and eight million households across 56 of the 63 cities and provinces in Vietnam, with most located in rural areas.

The PCFs have played an important role in developing the rural agricultural base in Vietnam. More recently, they have helped support a rural indus- trialization and SME development trajectory almost as impressive as in China. Often wrongly described as ‘microcredit institutions’, PCFs rather emphasize support for small enterprises and, in particular, semi- commercial family farms using land leased from the state. They tend to avoid supporting the typical subsistence activities and consumption loans targeted by mainstream profit-seeking microcredit institutions operating in the Global South.21 Another decisive factor here, as in China, was local governments’ efforts to provide quality collective services in parallel to the operations of the PCFs, such as irrigation and agricultural extension services that enabled small farms to ‘scale-up’ into much more productive semi-commercial family farming units linked to membership of their own agricultural cooperative.

Overall, the PCFs represent a successful cooperative financial institution model that has managed to achieve sustainable and equitable development goals. Despite ongoing lobbying from the international development com- munity for Vietnam to adopt more neoliberal local financial institutions, such as commercial microcredit,22 the PCF sector has continued to flourish in recent years.

Conclusion

Recent history shows that, since the 1980s, progressive local economic and social outcomes have not materialized under the dominant local neoliberal financial model in the Global South. The adverse experience of the global microcredit model is the main exhibit for this contention. There exists an abundance of positive experiences with alternative local financial insti- tutions since the 1950s, as the four case studies briefly presented above demonstrate. Such non-neoliberal local financial institutions possess at least three key attributes: (1) they are local state-, community-, or cooperatively owned and controlled; (2) they are not short-term nor profit-driven, but are willing to ‘get the prices wrong’ (e.g. use subsidies or investment) in order to carefully build long-term local economic development success; and (3) they emphasize the importance of strategically supporting community and cooperatively owned enterprises, rather than conventional investor-driven (capitalist) ones. This evidence clearly suggests that, given sufficient political will and popular mobilization, genuinely transformational progressive outcomes are possible with the right local financial model in place. Crucially, learning from the most successful progressive experiments can allow for building and maintaining often idiosyncratic financial models adapted to local conditions. The example of Cajamar in Spain demonstrates that it was possible to learn from Mondragón and its community development bank, while Vietnam’s recent success was built on the radical template provided by China’s initial and very successful non-neoliberal local financial model aided by the experience of Canadian financial cooperative models.

Nonetheless, replacing the local neoliberal model of finance with the sort of local community-owned and controlled alternatives outlined in the four case studies will not be easy. As highlighted in our analysis of microcredit, there is much neoliberal ideological baggage to contend with, and huge profit at stake for the financial elite. But history shows that the careful deployment and regulation of local state-, community-, and cooperatively owned financial institutions can be decisive in creating a more efficient and sustainable local economy. And not least this crucial goal can be achieved through support for the many types of democratic, participative and community-owned business enterprises that exist today and that have greatly enriched the lives of the average citizen since the mid-1800s.

About the author

Milford Bateman is a Visiting Professor of Economics at Juraj Dobrila at Pula University in Croatia, and an Adjunct Professor in Development Studies at Saint Mary’s University, Halifax, Canada. His main teaching, research and consulting interests lie in the area of local economic development, particularly the developmental role of the local state, local finance and all forms of cooperatives. His latest book published in January 2019 by Routledge in cooperation with UNCTAD and co-edited with Stephanie Blankenburg and Richard Kozul-Wright is entitled The Rise and Fall of Global Microcredit: Development, Debt and Disillusion.

Notes

1 See UNCTAD (2017) Trade and Development Report, 2016: Beyond Austerity: Towards a Global New Deal. New York: UN.

2 Bateman, M. (2010) Why Doesn’t Microfinance Work? The destructive rise of local neoliberalism. London: Zed Books.

3 Otero, M. and Rhyne, E. (Eds) (1994), The New World of Microenterprise Finance: Building healthy institutions for the poor, London: IT Publications. Robinson, M. (2001), The Microfinance Revolution: Sustainable Finance for the Poor, Washington DC: World Bank.

4 A notable example is Jonathan Morduch. Co-author of the leading textbook on microcredit, The Economics of Microfinance, and leading advisor to almost all of the major microcredit and fi- nancial inclusion bodies, he now accepts that microcredit has failed in its historic task of poverty reduction (see Morduch, J. [2017] ‘Microfinance as a credit card’ Limn 9. Available at: https:// limn.it/articles/microfinance-as-a-credit-card/

5 Mader, P. (2015). The Political Economy of Microfinance: Financialising poverty. London: Palgrave Macmillan.

6 Häring, N. (2017) ‘A well-kept open secret: Washington is behind India’s brutal experiment of abolishing most cash’, Norbert Häring: Money and More, 1 January. Available at: http://norber- thaering.de/en/32-english/news/745-washington-s-role-in-india

7 For example, Bateman, M., Duvendack, M. and Loubere, N. (forthcoming) ‘Is Fin-tech the New Panacea for Poverty Alleviation and Local Development? – Contesting Suri and Jack’s M-Pesa Findings Published in Science’ Review of African Political Economy.

8 Restakis, J. (2010) Humanizing the economy: Cooperatives in the age of capital. Gabriola Island, BC: New Society Publishers.

9 Restakis, J. (2010) Humanizing the economy: Cooperatives in the age of capital, Gabriola Island, BC: New Society Publishers.

10 For example, thanks to the high levels of solidarity and community generated because of the emphasis on the cooperative model, the ‘red’ region of Emilia Romagna has regularly topped European ‘Quality of Life’ surveys. See Bateman, M. (2007) ‘Financial cooperatives for sustainable local economic and social development’, Small Enterprise Development 18 (1): 37-49.

11 In the ‘reddest’ region of Emilia Romagna, for instance, many industries have contracted under pressure from lower cost competition from abroad. Nonetheless, today nearly 2 of every 3 citizens out of a population of 4.5 million are members of a cooperative, and around 30 per cent of the region’s GDP is generated in the cooperative sector. See Zamagni, V. (2018) ‘The Italian region where 30% of GDP comes from cooperatives’, Apolitical, 8 January. Available at: https:// apolitical.co/solution_article/italian-region-30-gdp-comes-cooperatives/

12 For example, the very first member of the MCC, Fagor, was forced into liquidation in 2013.

13 See Bateman, M. (2007) ‘Financial cooperatives for sustainable local economic and social development’, Small Enterprise Development, 18, (1): 37-49.

14 For example, Cajamar took the lead in addressing environmental issues related to the over-use

of pesticides and the increasing salinization of underground water supplies that became apparent across the region in the late 1960s. This involved the establishment of three experimental farms financed by Cajamar that would develop and disseminate solutions for all cooperative farms to adopt. See Giagnocavo, C., Fernandez-Revuelta Perez, L. and Ucles Aguilera, D. (2012) ‘The Case for Proactive Cooperative Banks and Local Development: Innovation, growth, and community building in Almería, Spain’, in S. Goglio and Y. Alexopoulos (Eds), Financial Cooperatives and Local Development, pp. 93-110. London: Routledge.

15 Girardin, E. and Ping, X. (1997) Urban Credit Co-operative in China, OECD Development Centre Technical Paper No 125. Paris: OECD.

16 O’Connor, D. (1998) ‘Rural Industrial Development in Viet-Nam and China: A study in contrasts’. MOCT-MOST 8: 7-43.

17 Naughton, B. (2007) The Chinese Economy: Transitions and growth. Cambridge, MA: MIT Press.

18 See Bateman, M. (2017) ‘Local finance for sustainable local enterprise development: The role of international development assistance in identifying and promoting best practice in a post-ne- oliberal world’. Invited paper presented at the Beijing Forum, 3-5 November, Peking University, Beijing, China. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3075417

19 For example, thanks to asset-stripping, self-awarding of high salaries and bonuses, profits taken out as dividends by new non-local owners and outright fraud, very many of the best TVEs were looted and then forced into bankruptcy by their new private owners. This spasm of private enrichment was one of the main reasons that inequality in China began to shoot up quite dramatically around this time. See Lee, C K. (2014) ‘A Chinese developmental state: Miracle or mirage?’, in M. Williams (Ed), The end of the developmental state? Pietermaritzburg, South Africa: University of KwaZulu-Natal Press.

20 See pp. 221-226 in R. H. Schmidt, R. H., H. D. Seibel, H. D. and Thomes, P. (2016) From Microfinance to Inclusive Banking: Why local banking works, Hoboken, NJ: John Wiley and Sons.

21 For example, the PCF’s average loan size in 2007 was US$931, which can be compared with the US$100 average in Bangladesh’s microcredit sector at this time (see Bateman 2010, op. cit, pp. 192 and 231).

22 For much of the 2010s, the World Bank was responsible for coordinating an intense lobbying effort against the Vietnam government to get it to accept the fundamental neoliberal imperative that all local financial institutions be market-driven, privately owned and financially self-sustaining – see pp. 191-198 in Bateman, M. (2010) Why Doesn’t Microfinance Work? The destruc- tive rise of local neoliberalism, London: Zed Books.