Haciendo negocio con la pandemia

Cómo los abogados se preparan para demandar a los Estados por las medidas tomadas en respuesta a la COVID19

Corporate Europe Observatory y el Transnational Institute

12 Junio 2020

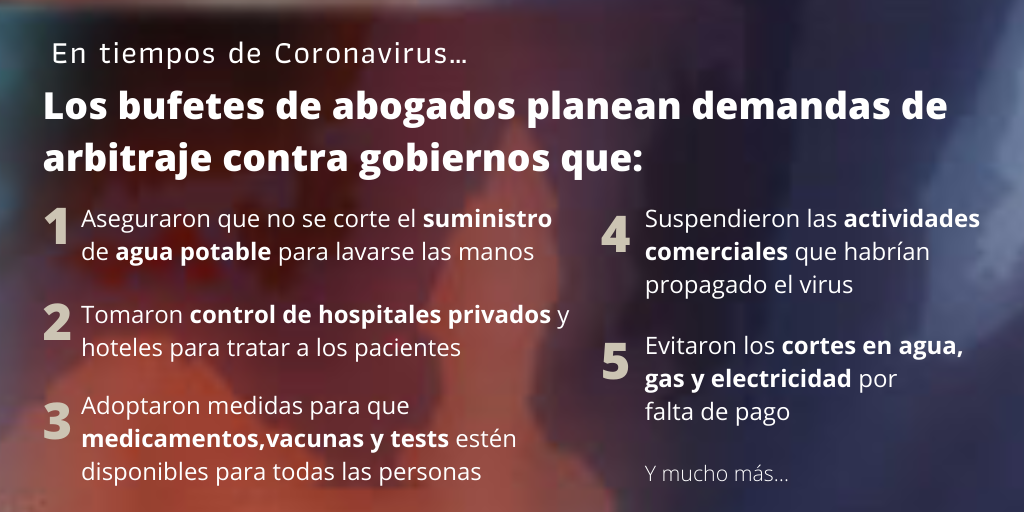

A medida que los Gobiernos adoptan medidas para luchar contra la pandemia de la COVID-19 y evitar la debacle económica, grandes bufetes de abogados también están observando el virus, aunque su preocupación no es salvar vidas ni a la economía, sino que están instando a grandes empresas a que impugnen las medidas de emergencia para defender sus ganancias. Algunos Estados podrían afrontar demandas multimillonarias en un sistema judicial paralelo para la solución de disputas entre inversores y Estados (ISDS, por sus siglas en inglés).

El 26 de marzo de 2020, Italia había superado las 8.000 muertes por Coronavirus –en aquel entonces, más del doble del número de muertes registrado en cualquier otra parte del mundo. Las morgues estaban desbordadas y ya hacía tiempo que los hospitales no aceptaban pacientes por motivos que no fueran de emergencia, ya que los médicos estaban luchando por salvar vidas. “Nunca había visto algo igual”, un médico dijo a un periodista. “Crees que todo está bien y luego, cuando ataca los pulmones, el virus convence al cuerpo de que debe luchar tanto que lo termina matando”.

El mismo día, miembros del bufete de abogados italiano ArbLit publicaron un artículo titulado “Could COVID-19 emergency measures give rise to investment claims? First reflections from Italy” (¿Podrían las medidas de emergencia en respuesta a la COVID-19 dar lugar a demandas de inversión? Primeras reflexiones desde Italia). En lugar de preocuparse por el número de muertes causadas por el Coronavirus en Italia, los abogados analizaron si las medidas que el Gobierno “coordinó en forma deficiente y elaboró precipitadamente” para evitar la propagación del virus y disminuir su impacto económico “podrían entrar en el ámbito de los tratados de inversión entre Italia y otros Estados, allanando el camino para que inversores extranjeros entablen demandas por daños y perjuicios contra Italia”.

“Una vez pasada la emergencia, los Estados deberán enfrentar demandas de arbitraje entabladas por inversores extranjeros en virtud de tratados bilaterales de inversión vigentes”. Abogados del bufete italiano ArbLit

Un sistema judicial paralelo para los ricos

En el mundo existen miles de acuerdos de comercio e inversión que otorgan amplias facultades a los inversores extranjeros, entre ellas el privilegio peculiar de demandar a Estados en un sistema de tribunales de arbitraje denominado mecanismo de solución de disputas entre inversores y Estados o ISDS, como se lo conoce por sus siglas en inglés. En los tribunales de ISDS, las empresas pueden reclamar indemnizaciones astronómicas por medidas gubernamentales que supuestamente perjudicaron sus inversiones, ya sea directamente, a través de la expropiación, o indirectamente, mediante reglamentaciones de cualquier tipo. El número de demandas de ISDS se disparó en el último decenio, al igual que el monto reclamado.

En los últimos años, el sistema de ISDS ha sido blanco de críticas severas por parte de juristas, sindicatos, ambientalistas, consumidores y otros grupos de la sociedad civil. Ha sido fustigado como un sistema judicial paralelo para los ricos, que otorga un trato más favorable a algunos de los actores más pudientes de la sociedad. El ISDS permite a los inversores extranjeros –y únicamente a ellos– eludir los tribunales y obtener indemnizaciones con dinero público, al que no podrían acceder en los sistemas judiciales nacionales. Un motivo es que los tribunales pueden conceder indemnizaciones a las grandes corporaciones por pérdida de beneficios previstos, que es algo no resarcible en la mayoría de los sistemas jurídicos. Otro motivo es la atribución de un mayor peso a los derechos de los inversores frente a otros intereses de la sociedad, al que se añade la ausencia de normas que limiten el poder de los tribunales para que no interfieran de manera indebida en el proceso democrático de adopción de decisiones (véase, por ejemplo, esta declaración de 202 catedráticos de derecho y economía de los Estados Unidos y esta de 101 catedráticos europeos). Las empresas nacionales, los ciudadanos y las comunidades no tienen acceso al ISDS.

Una ola de litigios vinculados a la pandemia

En medio de una crisis sin precedentes, el sector jurídico está preparando el terreno para entablar demandas costosas en virtud del ISDS contra las medidas adoptadas por los Gobiernos para responder a los efectos de la pandemia del Coronavirus en la salud y la economía. En avisos escritos y webinarios, los bufetes de abogados informan a sus clientes multinacionales de las amplias protecciones de los acuerdos de inversión para los inversores extranjeros como una herramienta para “solicitar una reparación y/o indemnización por las pérdidas resultantes de las medidas adoptadas por los Estados” (entrada de blog de abogados de bufete Quinn Emmanuel).

“Parece evidente que...la crisis actual generará demandas en virtud de tratados de inversión”. Aviso a los clientes del bufete de abogados Volterra Fietta sobre “COVID-19 y las demandas en virtud de los tratados de inversión”.

Como afirmóel bufete de abogados Ropes & Gray: “Los Gobiernos han respondido a la COVID-19 mediante la aplicación de numerosas medidas, entre ellas restricciones a viajar, limitación de las actividades comerciales y beneficios fiscales. Sin perjuicio de su legitimidad, estas medidas pueden afectar en forma negativa a las empresas al disminuir su rentabilidad, postergar sus actividades o excluirlas de los beneficios del Gobierno... Para las empresas con inversiones extranjeras, los acuerdos de inversión podrían ser una herramienta poderosa para recuperar o prevenir pérdidas provocadas por medidas gubernamentales relacionadas con la COVID-19”.

Dado que las disputas en virtud del ISDS “suelen suceder a crisis económicas, financieras y de otra índole” (abogados del bufete Debevoise & Plimpton durante un webinario), algunos abogados prevén el surgimiento de una “ola considerable de disputas en respuesta a la pandemia de la COVID-19” (anuncio del bufete de abogados Alston & Bird durante unwebinario ). Habida cuenta de que los costos legales de las disputas en virtud del ISDS son en promedio de alrededor de 5 millones de dólares por parte y en algunos casos han superado incluso los 30 millones de dólares, un auge de demandas sería un gran negocio para los bufetes de abogados.

Ya sucedió y volverá a suceder

El entusiasmo de los abogados no se basa en una fantasía. En los últimos 25 años, se entablaron más de 1 000 demandas entre inversor y Estado. Como señala un abogado del bufete Reed Smith “muchas de esas controversias surgieron a raíz de circunstancias sociales difíciles, como la crisis financiera en Argentina a comienzos de la década de 2000 o la Primavera Árabe a comienzos de la década de 2010”. Los inversores han ganado un número significativo de demandas de ISDS, dado que los tribunales de arbitraje fallaron que era ilegal interferir con los precios de los bienes esenciales, restringir o gravar la exportación de productos básicos o retirar incentivos a la inversión, entre otros. Ahora, una vez más “este y otro tipo de medidas adoptadas en respuesta a la pandemia de la COVID-19 podrían atraer demandas de arbitraje por la responsabilidad de los Estados en virtud de los tratados de inversión”, afirma el abogado de Reed Smith.

A medida que los Estados intentan combatir la pandemia y reconstruir sus economías, los casos de ISDS podrían implicar una enorme carga financiera adicional. “La indemnización por daños y perjuicios (y la exposición correspondiente para los Gobiernos) pueden ser enormes”, escriben los abogados del bufete Sidley en un análisis sobre “demandas en virtud de tratados de inversión por pérdidas relacionadas con la COVID-19”. Explican que: “Cuando una empresa gana una demanda en virtud de un tratado de inversión, puede recuperar todas las pérdidas provocadas por las medidas adoptadas por el Gobierno. Esto puede ir más allá de la inversión inicial (el costo real) y aplicarse al valor sumado a la pérdida de beneficios futuros”. La indemnización por la pérdida de beneficios hipotéticos es un motivo por el cual los laudos de ISDS pueden alcanzar las decenas de miles de millones de dólares y pueden ser más lucrativos que los fallos judiciales de tribunales nacionales.

“Resulta aberrante que estos posibles juicios y la compensación económica que solicitan se sumarán a la inmensa carga financiera de muchos Estados”. Investigadores del Transnational Institute, abril de 2020

Riesgo incalculable para los Estados

Mientras que los abogados alientan a todo tipo de accionistas a que contemplen la posibilidad de entablar demandas contra Estados en virtud de ISDS por medidas relacionadas con COVID, estos últimos afrontan un riesgo incalculable y posiblemente un número elevado de demandas. Como describen los abogados del estudio jurídico especializado en arbitrajes Volterra Fietta: “Los directores de empresas también deberían informar a sus accionistas que pueden entablar demandas de arbitraje entre inversor y Estado por su cuenta, independientemente de la empresa. Como se observó anteriormente, toda entidad de la cadena de propiedad empresarial podría tener derecho a entablar demandas de arbitraje entre inversor y Estado”.

En vista de este riesgo, expertos han instaron a restringir en forma permanente las demandas en virtud del ISDS entabladas contra Gobiernos por medidas adoptadas para combatir los efectos sanitarios, económicos y sociales de la pandemia de COVID-19. La Conferencia de las Naciones Unidas sobre Comercio y Desarrollo (UNCTAD) también sonó la alarma al respecto: “Las medidas de los Estados de limitar el impacto...negativo de la pandemia son muy diversas y varían de un país a otro”, escribió la UNCTAD el 4 de mayo de 2020 y advirtió: “Si bien estas medidas se adoptan para proteger el interés público y mitigar los efectos negativos de la pandemia...algunas podrían...exponer a los Gobiernos a procedimientos de arbitraje iniciados por inversores extranjeros”.

A pesar de que aún no se conocen casos de ISDS relacionados con el Coronavirus, abogados especialistas en inversiones están contemplando numerosos casos hipotéticos. Un análisis de informes jurídicos y webinarios recientes revela una gran variedad de medidas gubernamentales adoptadas para responder al Coronavirus que podrían impugnarse en arbitrajes futuros. A continuación figuran diez casos hipotéticos de litigios atroces elaborados por algunos de los principales bufetes de abogados especializados en el arbitraje internacional en materia de inversiones.

Caso hipotético 1: Demandas en virtud del ISDS contra las medidas de los Gobiernos de brindar agua limpia a la población para el lavado de manos

El lavado de manos es una medida de protección fundamental para impedir la propagación del Coronavirus, pero para ello se necesita tener acceso a agua limpia, lo cual puede resultar difícil para los hogares pobres. Por ese motivo, paises como El Salvador, Bolivia, Colombia, Honduras, Paraguay y Argentina han adoptado medidas para que proveen apoyo directo a los usuarios de agua. Por ejemplo, El Salvador decidió que las familias afectadas por la COVID-19 no tendrían que pagar la factura del agua durante varios meses. De modo similar, Argentina y Bolivia suspendieron la desconexión de los servicios de agua por falta de pago durante la crisis.

Si bien las medidas de brindar agua limpia a los ciudadanos fueron celebradas por el Banco Mundial, no hicieron ninguna gracia a los bufetes de abogados especializados en inversiones. “Las empresas de servicios, muchas de ellas de origen extranjero con derecho de inversor, se han quedado sin flujo de ingresos”, criticó Hogan Lovells en un aviso a sus clientes afirmó. El bufete de abogados sostuvo que, en los paises con inversiones privadas en este sector, esas medidas adoptadas por algunos Gobiernos para hacer frente a la crisis sanitaria “podrían alentar a los inversores extranjeros a recurrir a las protecciones que figuran en los tratados de inversión”.

“Los inversores extranjeros deben saber que los Estados no tienen total libertad para incumplir sus obligaciones en virtud de los tratados de inversión, sin perjuicio de la gravedad de la crisis”. Bufete de abogados Linklaters

In the midst of the crisis, investment lawyers also advise corporate clients to use the threat of ISDS claims as a powerful lobbying tool to keep prices for their products high. As lawyers from Volterra Fietta explain in an afirmó for their corporate clients: “Companies should be aware of the potential value of their investor-state arbitration claims whenever they are negotiating with states or state entities. Investor-state arbitration claims (or the threat thereof) can be a useful lever in such negotiations. This is especially true if negotiations concern the re-negotiation of tariff rates or other economic aspects of a contract with a state entity.”

Caso hipotético 2: Impugnar la ayuda a los sistemas de salud pública sobrecargados

To relieve overrun public hospitals and following public outcry over half-empty private ones refusing to admit COVID-19 patients, in March Spain’s Ministry of Health temporarily took control of private hospitals. Ireland, too, is using private hospitals as part of the public sector during the crisis. The health minister señaló: “We must of course have equality of treatment, patients with this virus will be treated for free, and they’ll be treated as part of a single, national hospital service.”

But the threat of investment arbitration against the public management of private hospitals looms large. According to lawyers from Quinn Emanuel, “investors in the healthcare industry could… have indirect expropriation claims if turning over control was involuntary”. The firm adds: “If the state does not return control after the end of the outbreak or if the state’s control left permanent harm to the investment, investors could also have a claim for indirect expropriation.” Investment treaties typically protect not only against direct expropriations (eg the taking of land) but also against indirect ones (eg when the state takes effective control but not ownership of property).

Lawyers have also set their sights on other attempts to prop up overburdened public health systems. The requisitioning of hotels (to turn them into hospitals) and protective masks as well as compelling companies to produce medical supplies (like General Motors being ordered to produce ventilators) are criticised by many law firms. “If the seizure of a private production lines [sic] to produce medical equipment… lasts for a sufficiently long period of time without adequate compensation, investors could have a claim for unlawful indirect expropriation” (Quinn Emanuel lawyers).

Even if governments have provided cost-covering compensation or indemnities, this might not be enough under international investment law, which require states to pay “prompt, adequate and effective” compensation, independently of the public purpose of an expropriation. As “national laws do not necessarily provide for the same compensation that would be due under foreign investment law” (Alston & Bird lawyer at minute 8’55 in this webinar recording), corporations could walk away with more money than they would ever receive in national or European court proceedings.

“National laws do not necessarily provide for the same compensation that would be due under foreign investment law.” Alex Yanos of Alston & Bird law firm

Scenario 3: Lawsuits against action for affordable drugs, tests and vaccines

The fate of millions of people rests on the discovery and mass production of low-priced medicines, vaccines and tests for COVID-19. To facilitate their development, production and supply, states are trying to make it easier to bypass pharmaceutical and device patents, which can stand in the way. One key tool is compulsory licences allowing individuals and companies other than the patent holder to produce and supply a product. Israel has already issued such a licence (for the import of an HIV drug, which could help coronavirus patients), Canada and Germany have made compulsory licensing easier, and resolutions with the same goal have been passed in Chile and Ecuador (for an overview see ). Doctors Without Borders, too, has instaron for “no patents or profiteering on drugs, tests, or vaccines used for the COVID-19 pandemic” and on governments “to suspend and override patents and take other measures, such as price controls, to ensure availability, reduce prices and save more lives.”

Investment arbitration lawyers, however, consider “governments… forcing producers to sell drugs at significantly discounted prices and/or taking the intellectual property for themselves and/or disseminating that intellectual property to third parties without permission” as expropriation by governments that could lead to claims under investment treaties (Alston & Bird lawyer at minute 27’48 in this webinar recording). “Imposing a cap on prices” for medical supplies, too, is identified as a target of coronavirus-related claims by foreign investors as they “may dramatically decrease sales revenues even for in-demand products” (law firm Hogan Lovells).

Scenario 4: Investor attacks on government restrictions for virus-spreading business activities

In April 2020, Peru’s Congress temporarily suspended the collection of highway tolls. The aim of the bill was to contain the spread of the coronavirus, protect the employees collecting the tolls from exposure and ease the transport of food and other essential goods. A similar measure had been taken by India in March, but has already been ended as part of the country’s lockdown relaxations.

Several investment law firms have referred to the Peruvian case arguing that “a foreign investment that suffers losses due to restrictions on business operations could have a claim against the host government for its losses” (Ropes & Gray). “Have the restrictions destroyed the value of the investment or prevented the company from controlling its foreign investment?… Are the restrictions proportionate to the risk?”, asked Ropes & Gray lawyers in a client alert entitled “COVID-19 Measures: Leveraging Investment Agreements to Protect Foreign Investments” and added that responses to such questions “may indicate a violation of an investment agreement.”

In a webinar on 29 April 2020, an Alston & Bird lawyer, too, questioned the proportionality and necessity of Peru’s action. He asserted that the government could have taken other, less harmful measures to protect public health such as introducing technological alternatives to in-person toll collection or paying the toll collectors for their losses (minute 49’20 in the webinar recording).

Asked about how countries should handle conflicting obligations towards the health of their citizens and foreign investors that same lawyer answered: “It’s gonna be very difficult for states… States will have to try to comply with both and be conscious to the fact that some tribunals will be unforgiving later on if their conduct runs afoul of their obligations under [an investment] treaty… I definitely think that some states will end up losing cases to investors – notwithstanding the way that it might come across as unfair” (minute 59’20 in the webinar recording).

“Some states will end up losing cases to investors – notwithstanding the way that it might come across as unfair.” Alex Yanos of Alston & Bird law firm

Scenario 5: ISDS suits against rent reductions and suspended energy bills for those in need

As whole households fall ill with COVID-19 and/ or are stripped of income because of job losses, politicians are considering relief for the payment of rent and bills. “I’m getting a lot of people who are pretty desperate and say they are not going to get beyond the next week”, a concerned MP of the UK Labour party told journalists in March, calling on the government to suspend utility bills to “halt some of the burdens”. In Spain, suppliers of water, gas and electricity have been banned from cutting supply if households cannot pay their bills. In France and other countries where some tenants can no longer pay pre-crisis rents, calls for mandatory rent reductions are becoming louder.

Investment lawyers are watching these debates with potential compensation claims by real estate and utility companies in mind. Referring to possible rent forgiveness in France and suspensions for energy bill payments in the UK, Shearman and Sterling pointed out that: “While helping debtors, these measures would inevitably impact creditors by causing loss of income.” The law firm went on: “Measures ostensibly taken to deal with a serious problem but otherwise disproportionately affecting certain businesses… may be inconsistent with international law… If suspension of payments to utility companies leads to bankruptcy, the question will arise whether the state considered appropriate financial assistance to address the suspension.”

In other words: states could lose ISDS cases over rent relief and suspended utility bills if tribunals find that the costs of these acts were ‘disproportionately’ shouldered by landlords and utilities registered overseas and the government did not do enough to support them.

“Our International Arbitration team has a vast experience in international investment law and arbitration, and stands ready to advise states and investors alike in relation to the government measures that have been or will be adopted in the context of the COVID-19 pandemic.” Shearman & Sterling lawyers

Scenario 6: Disputes over debt relief for households and businesses

Several governments have adopted regulatory measures that aim to soften the economic blow of the coronavirus crisis on individuals, households and businesses so that they can keep their homes and stores and avoid bankruptcy. Examples include suspensions of mortgage payments (for example, in Italia y Spain) and creditor protections (for example, in Germany) as well as moratoria on bankruptcy proceedings (for example, in Belgium).

Such measures could “give rise to indirect de facto expropriation claims” by creditors, which, during the measure, will have few powers to enforce their debts and payments against the affected debtors, argue lawyers from Italian law firm ArbLit. They add: “the investor might also allege that its access-to-justice right has been breached by the moratorium on bankruptcy proceedings”. Drawing on “past experience with the international disputes arising out [of] economic and financial crises”, law firm bufete de abogados Dechert, too, considers regulations such as suspended creditor protections as “sufficiently harmful to financial sector investors so as to give rise to investment disputes”.

Scenario 7: Legal action against – financial crises measures

As governments suspended much economic activity in an effort to slow the spread of the virus, the world economy has witnessed heavy losses and is facing a looming new debt crisis, particularly in the global south. To respond to the financial meltdown economists y international institutions are advocating capital controls (to curtail the massive, destabilising outflow of money) as well as a massive relief and restructuring of public debt, among other measures.

But such emergency measures could be challenged in ISDS tribunals, the law firm bufete de abogados Dechert argues in a briefing entitled “COVID-19 Economic Crisis: Protecting International Banking and Finance Investors”. The firm has compiled a long list of acts, which countries such as Argentina and Greece have adopted in response to past crises and which have later on been challenged in ISDS proceedings: the restructuring or default of sovereign debt, prohibitions on transferring funds and other capital controls to stabilise the financial sector, bank bailouts and bail-ins etc. “As seen from past investment disputes,” Dechert states, “economic and financial crises are the most common cause of governmental actions adverse to investors in the banking and finance sector.”

“When the actions of a government – even if nominally well-intentioned – cause injury to a foreign investor or its investment, international investment law provides protection as well as effective means of recourse against the state.” Law firm Dechert on protecting banks and financial investors in the COVID-19 economic crisis

The firm is aware that “domestic recourse against [such] emergency measures… will be highly restricted, with courts unwilling to second guess the political branches of governments and the regulatory decisions of central banks and financial regulators”. One reason for this is that domestic law balances the rights of foreign investors with other societal interests. Another explanation is the fact that domestic courts leave wide discretion to governments and parliaments in dealing with complex and urgent policy questions. ISDS, however, lacks these general doctrines of deference and balancing, which is why it is so attractive to corporations and their lawyers.

Scenario 8: Tax justice on trial

Many countries have adopted tax relief measures to support citizens and businesses with the challenges caused by the pandemic. Yet at one point governments might raise taxes to handle the dramatic budget deficits caused by increased public spending and the economic fallout from the pandemic. In this situation, calls for greater tax justice are gaining traction. In the UK, el atacante de US y India, for example, experts have proposed taxes on wealth and the super-rich, alegando that “those on the highest incomes, and those with wealth, are the only people who could afford to pick up… [the coronavirus crisis] bill”. Denmark and Poland have already banned companies registered in tax havens from accessing COVID-19 aid, a move that was welcomed by some tax justice campaigners.

Additional taxes and fairer tax deals, however, could come under fire in investment arbitrations. “In the future, governments will likely be more aggressive in enforcing tax laws generally in order to fund economic stimulus packages related to COVID-19,” warns Ropes & Gray. The law firm raises a number of questions, which “could indicate an investment agreement violation”, for example: “Are additional taxes being imposed that significantly reduce the value of the foreign investment?” and “Did the government guarantee the investor a specific tax rate or tax treatment that has since been revoked?” Another of the firm’s questions (“Are foreign investors or investments excluded from tax benefits or other economic relief?”) raises the spectre of potential ISDS disputes over the ‘discriminatory’ French, Danish and Polish bans for COVID-19 grants to tax haven companies.

“Sovereign measures in response to COVID-19 may violate foreign investment protections contained in international investment agreements (“IIAs”) if they are discriminatory or disproportionate.” Law firm Jones Day

Despite frequent ‘tax carve-outs’ in investment treaties, a growing number of ISDS cases has already challenged government tax decisions – from the withdrawal of previously granted tax breaks to multinationals to increased corporate, income and other taxes.

Scenario 9: Suing governments for not preventing social unrest

As coronavirus lock-down restrictions are taking their toll in poor neighbourhoods and countries, commentators predict a rise in social unrest. A Bloomberg columnist apuntó in April 2020: “This pandemic will lead to social revolutions… Behind the doors of quarantined households, in the lengthening lines of soup kitchens, in prisons and slums and refugee camps – wherever people were hungry, sick and worried even before the outbreak – tragedy and trauma are building up. One way or another, these pressures will erupt.”

Arbitration lawyers are already advising their multinational clients on how to defend profits in potential situation of coronavirus-related social turmoil. “If social unrest results in the looting of businesses, foreign investors might claim that the state has breached its obligation to provide full protection and security,” afirma Voltera Fietta. Similarly, law firm CMS suggests that states’ obligation to provide full protection and security to foreign investors “may assume greater relevance during the COVID-19 crisis, as inaction or reduced vigilance by states… may result in significant harm being cause to foreign investments”, particularly as “the COVID-19 crisis increases the risk of looting, especially in areas of reduced patrolling by the police or military.”

An ISDS ruling against Egypt from 2017 illustrates the types of scenarios that the investment lawyers have in mind. In this case, the tribunal sided with US investor Ampal-American, which had sued Egypt over a series of alleged interventions with a gas pipeline. Among other violations, the arbitrators found that Egypt had breached the full protection and security standards in the US-Egypt investment deal by not providing enough police protection to the pipeline, which suffered from sabotage attacks by militant groups in the wake of the Arab Spring. While the tribunal acknowledged the “difficult” circumstances at the time – when “armed militant groups took advantage of the political instability, security deterioration and general lawlessness” – it claimed that Egyptian authorities failed “to take any steps to stop saboteurs from damaging” the pipeline.

Legal scholars have criticised the ruling as “crazy” and completely ignorant of the “complex security conditions” during the Arab Spring. The case could nonetheless act as a precedent for similarly crazy rulings in future pandemic related ISDS cases.

Scenario 10: Booming business for litigation funders

Arbitration law firms are not the only ones betting on a deluge of disputes in the wake of COVID-19. Commercial litigation funders also hope to profit from the coming boom. These funders buy into ISDS claims, covering (parts of) the investor’s legal costs in the hopes of sharing in the spoils if a payout is awarded. Typically, a funder will take between 20 and 50 per cent of the final award.

“For arbitration and litigation funders, the past few weeks may mark the beginning of a boom.” News site Law360 in April 2020

As new providers have entered the litigation funding market in the last decade and existing funders have more money available, third-party funding of ISDS claims is likely to add to an additional spur to claims. As Freshfields, the world’s busiest law firm in ISDS disputes, predicts: “The increased availability of funding will provide much-needed ammunition to cash-strapped litigants, thereby fuelling the waves of litigation or arbitration following on the heels of the pandemic… This may contribute to more litigious plaintiffs and a generally more active disputes landscape than in the aftermath of the 2008 crash.”

A lawyer from the Holman Fenwick Willan (HFW) law firm adds: “Having access to third-party funding allows claimants to not only de-risk litigation, but also to completely remove the legal fees from their balance sheets. That will prove extremely attractive to many companies at the moment, and could mean that we start seeing COVID-19-related claims coming through sooner than they might otherwise.” Put differently: ISDS claims could hit states faster than imagined – and they could come with zero financial risk for the claimant investors.

Arguments to circumvent possible state defences

States will not be completely defenceless when hit by ISDS lawsuits over the measures they took in response to the COVID-19 pandemic. They can either justify their actions by drawing on public interest exceptions in the applicable investment treaty or on established emergency practices in international law. Both options, however, have their limits.

The first option is more theoretical than of practical relevance. Ninety per cent of the investment deals in force today are so-called old generation agreements with hardly any public interest exceptions, so provide little leverage for states. This is why, as DLA Piper concludes, “states commonly have little in the way of defences or exceptions that are spelled out in the treaties”.

Regarding the option of state defences under customary international law, investment lawyers draw on the many ISDS rulings against Argentina to come up with counter arguments for investors in the COVID-19 context. For the defence to hold, for example, states will need to show that the measures they took were the only way to deal with the harm caused by the pandemic. But as lawyers of Aceris Law have pointed out: “It can always be debated as to whether particular acts taken by states are the only means to safeguard an important interest, as the very different reactions of states to confront the COVID-19 pandemic in fact illustrate.”

In addition, states will need to show that they did not contribute to the emergency situation of the pandemic. Yet, investors could argue “that some states contributed to the crisis through lack of preparation for a foreseeable event” (Reed Smith) or that “states’ under-funding or under-resourcing of health care systems is a substantial contributing factor” to how hard the pandemic hit them (20 Essex lawyer). While this might well be the case, should an ISDS case then be used to rub salt in the wound of a depleted health system?

“Notwithstanding the fact that COVID-19 presents an unprecedented and fast-developing challenge, the guarantees given to foreign investors under IIAs [international investment agreements] remain relevant to an assessment of state action in response to the pandemic.” Law firm Herbert Smith Freehills

Get out of the treaties before it is too late

While the global public is following the coronavirus crisis fearing the decimation of whole continents, investment lawyers seem to be saying ‘we know it’s awful, but we should crack on with plundering public coffers through ISDS anyway’.

At a time when a global health crisis is compounded by a major economic crisis, the need to avoid ISDS claims has never been greater. This is why experts have instaron for a permanent restriction on such challenges to government measures targeting the health, economic and social effects of the COVID-19 pandemic – and for an immediate moratorium on ISDS lawsuits more generally. There is already a draft proposal for an agreement to suspend ISDS claims for COVID-19 related matters.

Another option is for countries to get out of existing ISDS deals. South Africa, Indonesia, India and many others have terminated some of their bilateral investment treaties. Just recently, 23 EU member states signed a treaty that will terminate some 130 bilateral treaties among them. Italy has left the Energy Charter Treaty which is basically a large ISDS deal for the energy sector. There are also proposals for how ISDS could be ended globally, in a less piecemeal approach. And clearly, states should not enter into any new ISDS deals, let alone the kind of world court for corporations which has been proposed by the European Commission, effectively an ISDS system for the entire globe.

“The need to avoid investor-state claims has never been greater.” International Institute for Sustainable Development (IISD)

In a recent Kluwer Arbitration about COVID-19 and international investment law, legal scholars raised two key questions: “What is the justification for maintaining a legal enclave where the wealthiest economic actors become entitled to a more favourable treatment than the other segments of society that suffer disproportionately as a result of the pandemic and the responses to it? Why do the grievances of investors vis-à-vis states and their expectations of continued profit levels deserve more robust protection than the obligation to ensure an adequate standard of living to the broader population?”

These questions get to the heart of the matter. There is no place for a parallel justice system for corporations. ISDS has to go.

Reconocimientos:

Publicado por Corporate Europe Observatory Transnational Institute

12 Junio 2020

Author: Pia Eberhardt

Illustration: Anastasya Eliseeva