This essay is part of the book Public Finance for the Future We Want, you can find the entire collection of essays here.

Sometime around 2008 Helgeland Kraft AS, a public hydropower company owned by 14 municipalities in the Nordland county of Norway, had an idea: to build aesthetically pleasing and environmentally sound power genera- tion stations. The power stations would service the energy needs of their communities, sustainably, while their beauty would inspire others to come and learn about clean energy.1 This too would contribute to Norway’s com- mitment to become carbon neutral by 2030. The initiative is an example of what is possible through public–public collaboration. While Helgeland Kraft kicked off construction in 2014, it was in 2016 that the Nordic Invest- ment Bank (NIB), a public bank, provided the extra financing needed for completion. Six new public, energy-efficient hydropower plants would be backed by a 15-year, €49.5 million loan.2 The NIB granted the loan because the energy project met its publicly mandated criteria for mitigating climate change, reducing pollution and contributing to local development.

The point here is neither to promote hydropower as environmentally unproblematic nor to suggest public banks are a financial cure-all. No. Rather, the point is that through public–public collaborations communities can realize the future they want on their own terms. Public banks can play a vital role in that future.

Indeed, as this chapter shows, public banks are enjoying a contemporary renaissance of sorts. Two conjunctural reasons help to explain why. First, the 2008-09 global financial crisis exposed the excesses of private finance and the poverty of neoliberal financialization strategies for development, while reaffirming that public banks can be a stabilizing force amidst economic instability. Second, to varying degrees critical scholars and development organizations, alongside global civil society, are frustrated with the failures of private finance to support a sustainable and just transition to a low-carbon, climate-resilient future. Both events have pushed public banks to the fore of the ‘finance for development’ debate, especially in relation to the new United Nations Sustainable Development Goals (SDGs). Here I focus on the potential of public banks to finance the sustainable future we want – a potentiality that will only be realized if struggled for.

What is now occurring in the area of ‘green’ or ‘sustainable’ finance is in many ways contrary to the letter of neoliberalism. Public bank funding is increasingly regarded by international development and financial institutions not as corrosive but as catalytic for the future of low-carbon infrastructure investments. This is something new. Yet the spirit of neoliberalism (i.e. the subordination of state, workers and society to the needs of private accumulation) remains very much alive. This spirit remains the same within these international institutions. Where private investors are unwilling to ‘risk’ their capital to invest in climate mitigation strategies and green infrastructure, then public banks should step in to de-risk private investments.3 The logic is that public support will help to leverage or draw in available pools of private finance. Private finance sees the investment as attractive because it has public backing, which increases the likelihood of higher returns. The overarching ‘new’ neoliberal narrative is that only by using public resources to mobilize private finance can we begin to raise the financial resources needed to tackle climate change. In short, public banks should socialize private risks to confront climate change. Or so the new neoliberal story goes.

Another future for public banks is not only desirable but possible. I argue that public banks have the potential to finance the transition to a sustain- able and equitable future in the public, not private, interest. Two premises support my argument. First, I show that the existing financial capacity of public banks far exceeds the inaccurate and misleading estimates provided by the international development community. That is, public banks have sufficient resources to take the lead in tackling the estimated $90 trillion in climate infrastructure investments needed – without first bending a knee to the profitability needs of private financiers. Second, I summarize the benefits of having a public bank, whose public policy functions can help maximize the efficacy of tackling climate change in the public interest. I conclude by pointing to the centrality of social struggle in determining the future orientation of public banking. To have public banks serve the public good, we must demand it.

The financial capacity of public banks

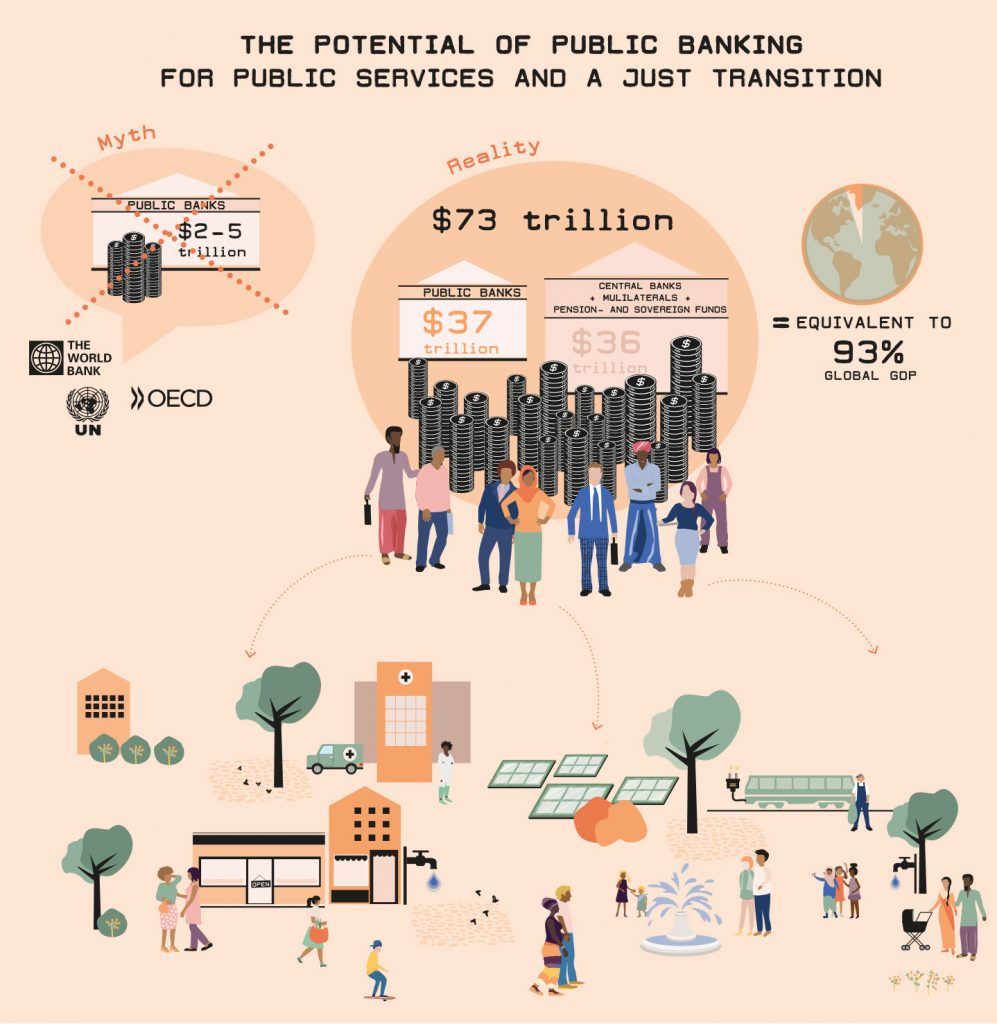

For neoliberal advocates and institutions such as the World Bank and Organisation for Economic Co-operation and Development (OECD), the actually existing financial capacity of public banks is of little interest. They already know that private bankers and financiers are the only viable, indeed preferable, solution for financing a low-carbon future. Could it be otherwise? Their official publications reinforce such neoliberal common- sense assumptions – but only by misrepresenting real public bank capacity.

Take for example the World Bank’s inaugural Global Financial Development Report 2013: Rethinking the role of the state in finance, which is written in response to the role played by public banks during the 2008-09 global financial crisis. The report states that public banks ‘account for less than 10 percent of banking system assets in developed economies and double that share in developing economies’ and it provides an estimate of only $2 trillion worth of assets held by public development banks (which comes nowhere near what these percentages would actually represent).4 For a report on the ‘state’ in finance, it is remarkable that no further details, no global numbers, and no accurate empirical sense of the public banking sector is given at all. A 2017 International Monetary Fund working paper on bank ownership fairs no better, recycling 2010 World Bank data to claim that public banks account for roughly 18 per cent of all banking assets in developing countries and 12 per cent in high income countries, but they too give no concrete indication of total numbers or combined public bank assets.5 One is simply left guessing. A contemporary OECD publication on climate finance has its own limitations. Setting aside concern for overall public bank control, the report focuses on public development banks. By its account, there are ‘more than 250’ such banks with assets of about $5 trillion.6 This would seem more realistic, but in fact it is still far from the mark. Yet today’s most important international body responsible for informing policy on finance for sustainable development (vis-à-vis the SDGs), the UN Inter-Agency Task Force on Financing for Development (IATF), reproduces this same figure.7 The IATF goes on to privilege public–private partnerships and advocate that public banks primarily support private investors.

Anyone interested in climate finance and wanting to understand the financing options available would be forgiven for thinking that public banks are not and could not be serious financial agents of change. What can $5 trillion do when we need $90 trillion?

Yet actually existing public banking capacity is far greater than what is commonly (mis)represented by the international development community. And this data on public banks, as it turns out, is not too hard to come by. Researchers can access information by using the Orbis Bankscope (Bureau VanDijk) online database, which specializes in banks and finance. Additionally, the annual Global Public Investor report by the Official Monetary and Financial Institutions Forum (OMFIF) provides information on public pension funds, sovereign investors and central banks.

Interpreting the data, however, requires some clarification. My focus is on public banks and bank-like financial institutions. Here a bank is considered as ‘public’ if it satisfies one or more of the following conditions: it is guided by a public mandate, governed under public law and/or publicly owned by state authorities or other public sector entities. In many cases, all three apply. In terms of ownership, I use a figure of 50.01 per cent plus as constituting legal public ownership.

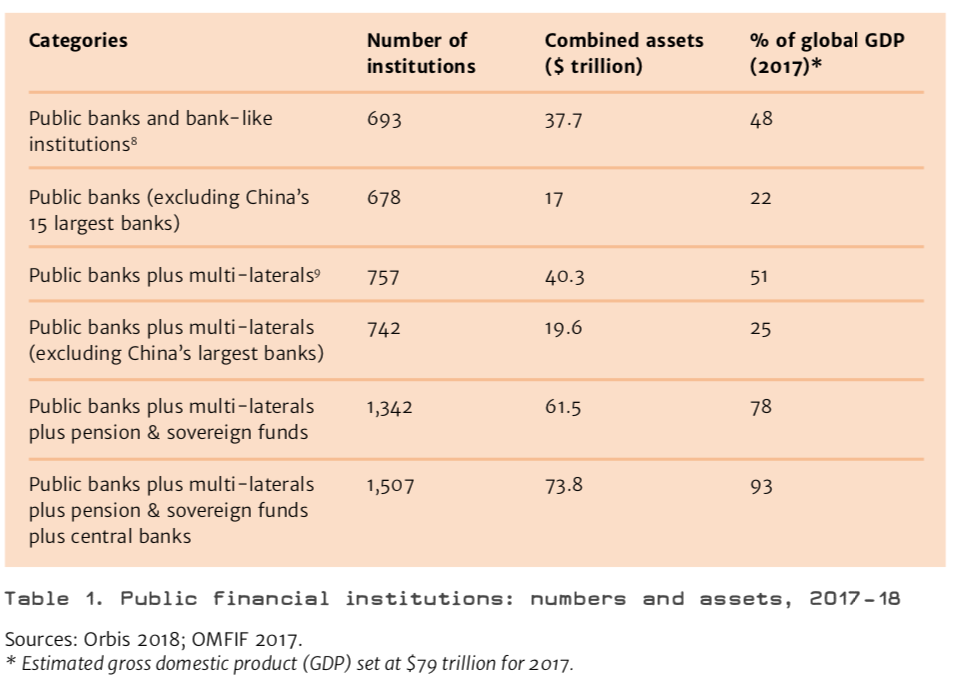

There too are different specializations of public financial institutions. Table 1 includes public banks, multi-laterals, pension and sovereign funds, and central banks (whose differences are not elaborated on here) to illustrate their institutional numbers and vast public financial resources.

Based on Orbis data, there are 693 public banks around the world. These banks control $37.72 trillion in assets, which is equivalent to 48 per cent of global GDP. Comparably, this constitutes 20 per cent of all banks, public and private.10 This is a far cry from what is typically represented.

There are other measures of public banks worth considering. One is the elephant in the room, China, which has 11 of the world’s largest 15 public banks that control assets totalling $20.6 trillion. Excluding these public giants, total global public banking assets come to just over $17 trillion (Table 1). The other public banks in the top 15 include Germany’s KfW Group ($567 billion in assets); the State Bank of India ($531 billion); and the failed private banks but then state-rescued Royal Bank of Scotland ($981 billion) and The Netherlands’ ABN AMRO ($943 billion). Other globally significant public banks include Russia’s Sberbank ($471 billion); Italy’s Cassa Depositi e Prestiti ($433 billion); and Banco do Brasil ($409 billion).

It is also worth noting that the public multi-lateral banks, of which there are 66 and which command the better part of the international devel- opment community’s reporting attention, have a comparatively modest amount of assets at about $2.6 trillion. When combined, public banks plus multi-lateral banks control over $40 trillion in assets.

Finally, it is interesting to reference the most expansive category of pub- lic banks, which includes multi-laterals, pension and sovereign funds, and central banks. These 1,507 public financial institutions have assets nearing $74 trillion, equivalent to 93 per cent of global GDP.

The point being that actual public financial institutional capacity, even by a relatively conservative measure of $38 trillion worth of just public bank assets, far outstrips anything represented in the UN system and OECD literature. There is, in fact, massive actually existing public financial capacity.

The neoliberal myth of public financial incapacity is most striking within the debate on financing low-carbon infrastructure.

According to the 2016 Delivering on Sustainable Infrastructure for Better Development and Better Climate report, infrastructure accounts for more than 60 per cent of all greenhouse gas emissions.11 Moreover, the permanence of infrastructure locks in such emissions often for decades. However, the financing of this new, needed low-carbon infrastructure is costly, risky and long term. As the slogan now goes, we need to turn climate investment from ‘billions into trillions’.12 But how to do it?

Estimates of the total investment needed vary, but it is largely thought that from 2015 to 2030 global society will need to spend about $90 trillion to meet our climate mitigation ambitions. This total investment exceeds the combined total of all current infrastructure stock. This means global low-carbon public and private investments need to increase from roughly $3.4 trillion to over $6 trillion annually.13

Herein lies the rub. If you are led to believe that public banks control at best $5 trillion in total assets, then raising $6 trillion annually seems insurmountable. You would obviously need to tap private markets. But, if you understood that public banks alone have closer to $38 trillion in assets then the realm of the possible is radically different. Suddenly, public rather than private interests can be the catalytic force in financing a low-carbon transition. We can actively bank on the sustainable and equitable future we want, bypassing the need to subordinate climate justice to financialized, private and profit-making imperatives. This suggests that the potential of public banking should be at the centre of debate and climate-action strategies.

The potential benefits of public banking

Over the last five years or so the potential public benefits of owning and controlling a public bank have slowly begun to be rediscovered by civil society, policy-makers and academics interested in alternatives to private finance, and indeed neoliberalism. The reasons are diverse but often revolve around public banks being able to, potentially, serve the public interest (such as a just energy transition) rather than private interests and profit motives.

For example, a 2017 report by the European Network on Debt and Development (Eurodad, a network of 47 civil society organizations from 20 countries) surveyed the literature and consulted their global partners on public banking.14 The subsequent report highlights some key benefits of public banks, which as matter of public policy, can:

- Direct finance to priority economic sectors and geographic regions;

- Build the financial sector, by filling gaps in the credit supply or demand

left open by the private sector; - Promote economic stability, by playing a counter-cyclical lending role at

times of economic instability; - Improve financial standards, by insisting on social, environmental or

human rights safeguards.

The ability of public banks to direct, build, promote and improve finance contributed to the UN highlighting their sustainable development potential. Notably, the final report of the 2015 Financing for Development Conference in Addis Ababa pointed out that public development banks should play a key role in reaching the SDGs. Working from the resultant ‘Action Agenda’, the UN Conference on Trade and Development (UNCTAD) has argued that public banks could in fact do much more to scale up their often-conservative loan-to-equity ratios.15 That is, their lending portfolio could be extended well beyond their current $38 trillion in assets.

This capacity is not neutral, however. Those wanting to ensure a just cli- mate transition – for workers, women, the poor and marginalized – need to forefront public interest, sustainability and equity concerns in ways that directly confront and contest, for example, World Bank approaches (‘Maximizing Finance for Development’16) that fundamentally serve to further the private accumulation of capital over any public or common good.

There are concrete ways public banks can confront neoliberal developmen- talism and, by extension, support a just future.17 Public banks can offer a source of public revenue that can be used to cross-subsidize public projects and programmes. In addition to privileging green development strategies, public banks can commit to gender justice – as Costa Rica’s Banco Popular y de Desarrollo Comunal has explicitly done.

By developing their own institutional capacities, public banks can contribute to overall public sector expertise and independence from ‘market’ forces as illustrated by Germany’s KfW, created in the wake of World War II. Add to this that public banks can function at the heart of willing public sector coalitions interested in fulfilling policy priorities, notably on infrastructure, as the Nordic Investment Bank has done. In building such domestic public financial capacity and knowledge, public banks can work as a countervailing political force against the dominance of private (often foreign) banks over public policy formation and implementation. To this, for better or worse, China’s public banks are a testament. This rationale for domestic public banking capacity informed post-war nationalizations in places as diverse as Cuba, India and Vietnam as well as public bank creations in Canada, the US and Turkey, to name but a few examples.

Today, it remains the case that public banks can operate indefinitely without a profit-maximization imperative if given a public mandate to do so. This can help to minimize the effect of hyper-competitive global financial imperatives on society. It can also reduce the cost of borrowing for priority sectors. This helps us make sense of why public banks are emerging as central actors in the sustainable finance agenda. But more must be done to maximize the potential of public banks to work in the public interest.

It would be a mistake to believe that just states, policymakers or even academics see the benefits of public banking. Ordinary people see it too. In smaller communities a public bank may be the only bank offering financial services and credit support, as is the case of Ziraat Bank in Turkey and of Caixa Econômica Federal in Brazil. The same scenario exists with the world’s newest public banks, the Territorial Bank of American Samoa, which filled the vacuum left by the private Bank of Hawaii after it withdrew from the island, and is now a fully functioning public retail bank operating under the motto of Faletupe o le Atunu’u (the People’s Bank).

Perhaps even more remarkable is the rise of a strong public banking social movement across the US.18 From Los Angeles to New York, New Jersey to Oakland, bottom-up popular responses to the failures of Wall Street banks to provide for communities have pushed governing authorities to rethink the potential of public banks.19 In recent years a number of municipal and state governments have commissioned economic feasibility studies, all of which have demonstrated the viability and desirability of public banks for local budgets and development.20 Social movements have picked up on the conclusions. For example, the ‘Public Bank LA’ movement – formed out of the California Public Banking Alliance, itself supported by the nation- wide Public Banking Institute – has emerged with a mandate to help establish a socially and environmentally chartered municipal ‘Public Bank of Los Angeles’.21 Reflecting the known benefits of public banks, the Public Bank LA movement lists the five most relevant to them: 1) save money; 2) community development; 3) ethical allocation of money; 4) local self- determination; and 5) serve the unbanked and the underbanked. Far from utopian, such public banking principles inform the mandates of public banks, past and present.22 The formidable German public banking sector, for example, explicitly explains its raison d’être as ‘acting in the public interest’ as opposed to profit maximization.23

The struggle for banking publicly

Banking publicly is to bank in the public interest, which in itself is a matter of contestation and social struggle involving crosscutting issues of class, gender, culture, race and ecology. There is, therefore, nothing easy about banking publicly on the future we want. For this reason, the placement of social struggle before any notion of a ‘public’ bank is necessary. Public banks will have troubles, which are generated within societies and are as much political and social as they are economic, and they are not beyond critical assessment, transparent accountability and self-reflective improvement for the mere fact that they are public. To suggest otherwise leads to dogmatism. Where public banks are abused for personal or political gain, this must be confronted and offenders held to account. If public banks fail to perform according to their mandates, open reviews of their operations need to inform change. To be sure, neoliberal detractors of public banks will say this is all very well but that the truth of the matter is public banks are inherently inefficient and prone to corruption, and that they ultimately undermine development.24 Privatization is the preferred course of action since private banks are economically superior (read: profitable). Research shows this not to be the case.25 History, too, points to the credibility of public banking in ways that can support a more progressive public ethos without having to prioritize profitability above all else.26

To emphasize the point, though, it is the social context, the social struggle to reclaim public banks in the public interest, that will define their future viability – not merely whether a bank is publicly owned or not.

Yet, more than any other public financial institution, public banks have been under- and misrepresented by the international development community. As importantly, critics of neoliberalism have failed to appreciate public banks as a strategic location of social struggle. Communities can make a difference over the content of public banks’ operations more di- rectly than, say, over the operations of the multi-laterals or even central banks. Exerting popular control over public banks in the common interest may offer one of our best hopes of breaking with neoliberal strategies of development. Public banks deserve our future attention.

About the author

Thomas Marois is a Senior Lecturer of Development Studies at the SOAS University of London. He spe- cializes in finance and development in emerging capitalisms. His current research focuses on the re- surgence of public banks and their potential to sup- port alternative green and equitable development. He is a member of the Municipal Services Project and works closely with civil society organizations on topics of alternative finance and the public provi- sioning of essential services.

Notes

1 Dredge, S. (2016) ‘Beauty and power: how Norway is making green energy look good’, The Guardian, 8 September. Available at: https://www.theguardian.com/environment/2016/sep/08/ norwegian-power-station-ovre-helgeland-hydroelectric-renewable-energy

2 Nordic Investment Bank (2016) ‘NIB funds six hydropower plants in Norway’, 5 April. Available at:

https://www.nib.int/who_we_are/news_and_media/news_press_releases/1836/nib_funds_ six_hydropower_plants_in_norway (retrieved 27 March 2019). The NIB is state-owned by five Nordic countries, Denmark, Finland, Iceland, Norway and Sweden, and three Baltic countries, Estonia, Latvia and Lithuania.

3 OECD (2017) Investing in Climate, Investing in Growth. Paris: OECD.

4 World Bank (2012) Global Financial Development Report 2013: Rethinking the role of state in

finance. Washington, DC: World Bank, pp. 120-21; 103. To be fair, an earlier 2012 World Bank background report estimates that public banks control some 25 per cent of all banking assets globally (de Luna-Martínez and Vicente 2012, p. 2). However, the source of this estimate is not given in the report. Likewise, the report offers no sense of total institutional numbers or geographical distribution. As significantly, the international development community has essentially dropped all reference to 25 per cent of all banks being public in subsequent reports. See: de Luna-Martinez, J. and Vicente, C. L. (2012) ‘Global survey of development banks’. Policy Research working paper no. WPS 5969. Washington, DC: World Bank. http://documents.worldbank.org/ curated/en/313731468154461012/Global-survey-of-development-banks.

5 Cull, R., Martinez Peria, M. S. and Verrier, J. (2017) ‘Bank Ownership: Trends and Implications’. IMF Working Paper, WP/17/60. Washington, DC: International Monetary Fund.

6 OECD (2017) Investing in Climate, Investing in Growth. Paris: OECD. p. 273

7 IATF (2017) Financing for Development: Progress and Prospects. Report of the Inter-agency Task Force on Financing for Development 2017. New York: United Nations Inter-Agency Task Force, p. 16.

8 Hereafter referred to as simply ‘public banks’. This category includes 10 Orbis-designated specializations: commercial banks; savings banks; cooperative banks; real estate & mortgage banks; investment banks; Islamic banks; other non-banking credit institutions; specialized governmental credit institutions; micro-financing institutions; and publicly owned private banking/ asset management companies.

9 Orbis. Bureau van Dijk. [Online]. Available at: https://www.bvdinfo.com/ (retrieved 10 May 2018). Orbis lists 66 multilateral banks with combined assets of $3.72 trillion. This total, however, includes as its largest contributor the European Stability Mechanism (ESM), with assets of $836 billion, the European Financial Stability Facility (EFSF), with $198 billion in assets, which I exclude as contributing to the multilaterals’ total assets.

10 For curiosity’s sake, if you wanted to extend the measure to publicly influenced banks, taking

a 25 per cent or higher level of public ownership in the Orbis database, you would see there are 1,037 public banks controlling over $48 trillion in assets.

11 Bhattacharya, A., Meltzer, J. P., Oppenheim, J., Qureshi, Z. and Stern, Lord N. (2016) Delivering on Sustainable Infrastructure for Better Development and Better Climate. London: New Climate Economy.

12 OECD (2017) Investing in Climate, Investing in Growth. Paris: OECD, p. 272.

13 Bhattacharya, A., Meltzer, J. P., Oppenheim, J., Qureshi, Z. and Stern, Lord N. (2016). Delivering on Sustainable Infrastructure for Better Development and Better Climate. London: New Climate

Economy, p. 26.

14 Romero, M. J. (2017) Public development banks: towards a better model. Brussels: Eurodad.

Available at: http://www.eurodad.org/Public-Development-Banks-towards-a-better-model.

15 UNCTAD (2018) Scaling up Finance for the Sustainable Development Goals. UNCTAD/GDS/

ECIDC/2017/4. Geneva: United Nations Conference on Trade and Development.

16 World Bank (n.d.) Maximizing Finance for Development. Available at: http://www.worldbank.org/

en/about/partners/maximizing-finance-for-development (retrieved 3 April 2019).

17 Marois, T. (2017) How Public Banks Can Help Finance a Green and Just Energy Transformation.

Amsterdam: TNI; Marois, T. (2015) ‘Banking on Alternatives to Neoliberal Development’, in L. Pradella and T. Marois (eds.) Polarizing Development: Alternatives to neoliberalism and the crisis. London: Pluto Press, pp. 27-38.

18 Jones, S. (2018) ‘Why Public Banks Are Suddenly Popular’, The New Republic, 10 August. Available at: https://newrepublic.com/article/150594/public-banks-suddenly-popular

19 See the Public Banking Institute website for current updates: http://www.publicbankinginstitute. org/

20 McGhee, H.r C. and Judd, J. (2011) Banking on America: How mainstreet partnership banks can improve local economies. New York: Demos. Available at: https://www.demos.org/sites/default/ files/publications/Demos_NationalBankPaper.pdf (retrieved 13 September 2018); SFPBTF (2018) Final Report to the Santa Fe City Council. Santa Fe Public Bank Task Force, 17 April. Available at: https://www.santafenm.gov/public_bank_task_force (retrieved 20 September 2018).

21 See Public Banks LA website: https://publicbankla.com/.

22 Marois, T. (2018) Towards a Green Public Bank in the Public Interest. Geneva: UNRISD.

Available at: http://www.unrisd.org/unrisd/website/document.nsf/(httpPublications)/6F7C5293F- 1419157C125823D00520D91?OpenDocument; Marois, T. (2017) How Public Banks Can Help Finance a Green and Just Energy Transformation. Amsterdam: TNI.

23 AGPB (2014) Promotional Banks in Germany: Acting in the public interest. Berlin: Association of German Public Banks.

24 La Porta, R., Lopez-de-Silanes, F. and Shleifer, A. (2002) ‘Government ownership of banks’, The Journal of Finance, 57(1): 265-301; Cull, R., Martinez Peria, M. S. and Verrier, J. (2017) ‘Bank Ownership: Trends and implications’, IMF Working Paper, WP/17/60. Washington, DC: International Monetary Fund.

25 Levy Yeyati, E., Micco, A. and Panizza, U. (2007) ‘A Reappraisal of State-Owned Banks’, Econo- mia, 7(2): 209-47; von Mettenheim, K. and Butzbach, O. (eds.) (2014) Alternative Banking and Financial Crisis. . London: Pickering & Chatto.

26 Marois, T. and Güngen, A. R. (2016) ‘Credibility and Class in the Evolution of Public Banks: The Case of Turkey’, Journal of Peasant Studies, 43(6): 1285-1309.