Paying for the Pandemic

and a Just Transition

Ben Tippet

Paying for the Pandemic and a Just Transition

Ben Tippet

11 November 2020

Caught between crises

In 2021, California experienced the largest forest fires on record. The smoke, whipped up by the flames, made it impossible for people to go outside without harming their lungs. Yet, due to the COVID-19 pandemic, meeting friends and family inside, and away from the smoke, risked catching the disease. Despite living in the richest state in the most powerful country in the world, its citizens were stuck, caught between two globally systemic crises – a spreading fire amongst a spreading virus.

This type of Catch-22 situation is not new for many around the world, particularly those in the Global South, who have long had to navigate the harsh realities of a broken international financial system and climate breakdown. The same month that fires raged in the USA, Bangladesh suffered the heaviest rainfalls in a decade, leaving a third of the country underwater. In the words of the Prime Minister Sheikh Hasina, ‘Bangladesh is trying to save lives, shore up healthcare systems, and cushion the economic shock for millions of people, all while avoiding fiscal collapse. But this is not a cry for help; it is a warning.’1

Whether it’s rehousing millions of displaced people in Bangladesh, or injecting trillions into the global economy to keep things afloat during the pandemic, the costs of these crises will continue to mount. As the debts rise, many will be asking, “Who is going to pay for all this?”

This report answers this question by bringing together ten progressive proposals that could pay for the costs of the pandemic and finance a just transition to a better world. In the words of economist Jayati Ghosh, this transition requires a “global multicoloured new deal: red, green and purple”. Red – to fight against extreme wealth inequality, consolidation of corporate power and global poverty. Green – to prevent the imminent breakdown of ecological systems. Purple – to put essential care work at the center of our economic value system, acknowledging that working-class women across the world carry the heaviest burden of these crises.

This report starts by looking at the costs of COVID-19 and estimates of what finance we would need to implement some of this multicolored new deal, before outlining ten progressive proposals that could cover these expenditures.2 What makes these proposals progressive is that they are designed to make those with the broadest shoulders pay.

Spending and Income 2021–2031

Estimated spending

$9.410

trillion

Over the next 10 years, this report estimates that the globe needs $9.410 trillion each year to repay the costs of the pandemic, to fight climate change, to pay US slavery reparations and to tackle the sustainable development goals.

Income from proposals

$9.457

trillion

We have the resources to do this. The report estimates that the global annual revenue from just ten progressive policies listed below will raise $9.457 trillion annually – enough to pay these costs.

The figures are put together from pre-existing policy proposals from international organizations, think tanks, academics and social movements. Some of these estimates are generally conservative and easier to implement. Meeting commitments to justice and fairness would require higher tax rates, more debt cancellation and further fiscal spending. Other proposals are more ambitious, and are only in their embryonic stages of development. These proposals reflect the orders of magnitude of potential funds rather than a specific program of action.

Due to low interest rates and a lack of capacity in the economy, even the IMF now agrees that rich governments who control their own currency can increase spending without having to increase taxes. This is a welcome departure from the false austerity narrative of the past 10 years, that the books always need to be balanced. It follows that rich governments should spend whatever is needed today, while designing and coordinating new taxes that in the future can reduce inequality and take purchasing power out of the hands of the rich. This unconstrained ability to spend your way out of a crisis, however, has never been open to countries in the Global South. The recent legacy of neoliberal policies and the longer history of colonial inequality has left many low-income countries unable to properly run their health and economic systems, showing the desperate need for the reforms set out in this report.

Lastly, raising finance is not sufficient to delivering systemic change to our unjust global economy. To ‘build back better’, more than just money will have to be mobilised. This report points throughout to examples of structural change that could start to change the balance of power away from a small financial elite towards a more democratically-controlled economy. The aim of the report is to present aggregate figures while also highlighting real life examples that can act as a blueprint for a future that treats humanity with equity and dignity. Ultimately, the $9.457 trillion a year headline figure drawn from these proposals show that moving towards a just world depends on political power rather than availability of financial resources.

Breakdown of Spending and Proposals

Expenditure / Revenue each year over the next 10 years (in $billions / year)

SPENDING ONE: To pay back the fiscal measures already announced to combat the pandemic, governments will need to repay $1.244 trillion per year over the next 10 years

$1244

SPENDING TWO: The Global South needs the equivalent of $283 billion a year over the next ten years to combat COVID-19 and its immediate economic impacts

$283

SPENDING THREE: $3 trillion per year is needed to de-carbonise the global economy and fight climate breakdown

$3000

SPENDING FOUR: $3 trillion per year is needed to achieve the UN sustainable development goals

$3000

SPENDING FIVE: In the United States alone, reparations of $1.583 trillion a year for the next ten years would repay the lost wages during slavery

$1583

SPENDING SIX: $300 billion per year is needed in climate reparations to pay for the loss and damages of climate change in the Global South

$300

Global annual spending required

$9.410 trillion

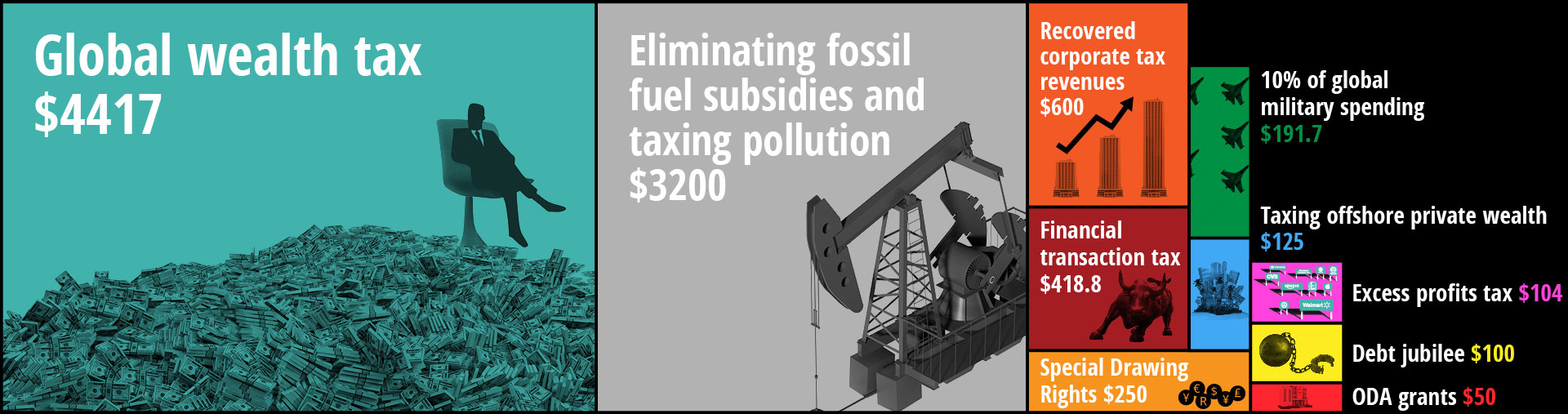

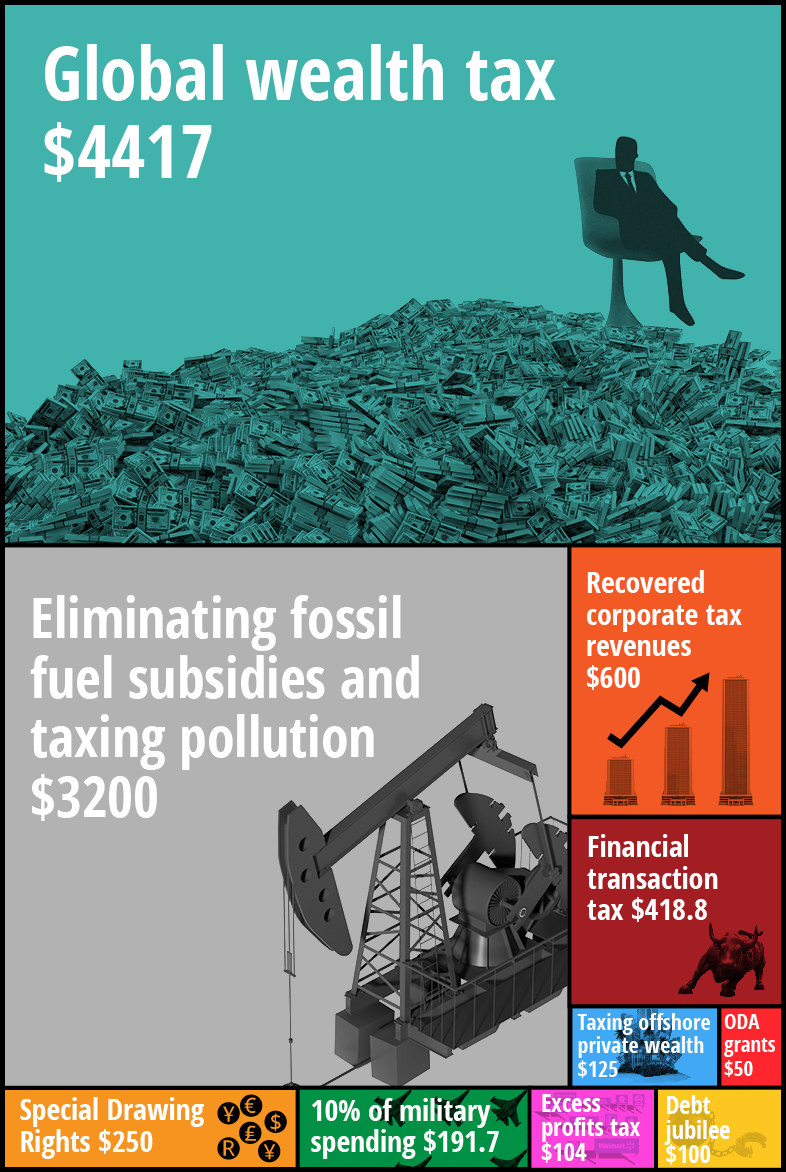

PROPOSAL ONE: A global wealth tax could raise $4.417 trillion a year

$4417

PROPOSAL TWO: Taxing the capital income from offshore private wealth could raise $125 billion a year

$125

PROPOSAL THREE: An excess profits tax on the 32 most profitable global companies could raise $104 billion a year

$104

PROPOSAL FOUR: Taxing offshore corporate profits could raise $200–$600 billion a year

$600

PROPOSAL FIVE: A financial transaction tax could raise between $237.9 and $418.8 billion annually

$418.8

PROPOSAL SIX: Eliminating public subsidies to the fossil fuel industry and implementing a tax on the cost of pollution could raise an extra $3.2 trillion a year

$3200

PROPOSAL SEVEN: Redirecting 10% of global military spending towards fighting the real security crises could raise $143.7–$191.7 billion a year globally

$191.7

PROPOSAL EIGHT: A debt jubilee, of the size called for by UNCTAD, could free up the equivalent of $100 billion a year for the Global South over the next ten years

$100

PROPOSAL NINE: A new issuance of Special Drawing Rights could free up the equivalent of $250 billion a year for the Global South over the next 10 years

$250

PROPOSAL TEN: A new Marshall Plan, of the size called for by UNCTAD, could raise the equivalent of $50 billion a year for the Global South over the next ten years

$50

Global annual revenue from progressive policies

$9.457 trillion

Spending Required to Fight the Pandemic and a Just Transition

This report addresses six necessary expenditures required to fight the pandemic and transition to a just economy.3 The first two deal with the immediate costs of the pandemic, while the last four deal with costs of preventing climate breakdown, achieving the sustainable development goals and paying reparations for slavery. However, the cost of building a better world following COVID-19 is not limited to them alone, nor can these expenditures compensate for years of structural inequality and a colonial legacy. The pandemic is threatening to push half a billion more people into poverty4 and 71–100 million into extreme poverty.5 This will increase the total number of women and girls living in extreme poverty to 435 million, with projections showing that this number will not revert to pre-pandemic levels until 2030.6 Half of global workers are at risk of losing their jobs.7 While these immediate economic costs are devastating, they do not have a clear monetary bill attached and are therefore not included in the aggregate figures below.

Spending Total: $1.244 trillion

Spending One:

To pay back the fiscal measures already announced to combat the pandemic, governments will need to repay $1.244 trillion per year over the next 10 years.8

Governments have already announced $11 trillion in fiscal measures to deal with the pandemic. This includes all the additional spending, tax cuts, loans, equity injections and guarantees that governments announced (as of 12 June 2020) to fight the pandemic. One half of these measures ($5.4 trillion) comes from additional spending and forgone revenue which directly leads to increased government deficits and debt. The remaining half ($5.4 trillion) is liquidity support (loans, equity injections, and guarantees) which could add to government debt and deficits down the road, but only if these public interventions incur losses.9 At current interest rates, $11 trillion is the equivalent of paying back $1.244 trillion per year for the next 10 years.10

While the fiscal response has helped to keep the economic system afloat, much of this public money has disproportionately benefited big corporations and polluting industries,11 with the G20 pumping at least $181.43 billion into fossil fuel companies alone without any conditionality attached.12

Spending Total: $1.527 trillion

Spending Two:

The Global South needs the equivalent of $283 billion a year over the next ten years to combat COVID-19 and its immediate economic impacts.

The Global South has been prevented from implementing the same level of unprecedented state support seen in the Global North. As discussed below, record high levels of debt and capital outflows have drained resources from the Global South at exactly the point it needs to invest in health, social care and economic support systems. Shockingly, sixty-four countries currently pay more on debt servicing than on health care.13 Both UNCTAD and the IMF estimates that the Global South requires an extra $2.5 trillion immediately to meet these financing needs. If this was taken out as debt today, repaying it over the next 10 years would cost global governments $283 billion a year in repayments.

Spending Total: $4.527 trillion

Spending Three:

$3 trillion per year is needed to de-carbonise the global economy and fight climate breakdown.14

Fighting climate breakdown requires de-carbonising energy production, manufacturing processes, transportation, the heating and cooling of buildings and agricultural processes. Breaking down the costs per region however, shows that even $3 trillion is an under estimation of the true costs of de-carbonisation. Researchers analysing a potential EU Green New Deal have recently argued that it will take €855 billion a year in the EU25 to implement a successful transition.15 Furthermore, $2 trillion of the $3 trillion would have to be paid to the Global South, according to a report by the People’s Policy Project.16 They propose this should be paid into the Green Climate Fund, the United Nation’s primary financing vehicle for the fight against climate change. $2 trillion is however 20 times larger than the commitments governments made in the Paris accord, which the Global North is already failing to meet.17 Other estimates for how much needs to be raised are generally in the $1–3 trillion mark.18

Spending Total: $7.527 trillion

The seventeen UN Sustainable Development goals20 aim to rid the world of poverty and hunger, providing clean water, energy, education and sanitation to all. While the goals have been criticised for their over reliance on private funding21, which tends to result in a drain on public budgets, the $3 trillion figure here suggests the scale of resources that is required to provide basic rights and goods to all the world’s citizens.22

Spending Total: $9.11 trillion

Spending Five:

In the United States alone, reparations of $1.583 trillion a year for the next ten years would repay the lost wages during slavery.23

As Black Lives Matter protests sweep the world, the call for reparations to repay the crimes of colonialism and slavery have grown. One estimate puts a current estimate of the lost wages of slavery in the USA alone at $14 trillion24 – the global figure will be much bigger. If reparations of $14 trillion given out today, repaying the debt over the next 10 years would be the equivalent of $1.583 trillion a year. Other groups pushing for global reparations for slavery include the federation of Caribbean countries (Caricom)25 and the Movement for Black Lives in America.26

Spending Total: $9.41 trillion

Spending Six:

$300 billion per year is needed in climate reparations to pay for the loss and damages of climate change in the Global South.27

Just like the story of Bangladesh at the beginning of this report, many countries in the Global South are on the front line of the climate crisis, suffering irreversible losses and costly damages from droughts, floods, typhoons and hurricanes. The historical injustice of climate change, as discussed in detail in section 4 below, means that the countries most exposed and least able to deal with the consequences of the climate crisis are suffering its worst effects. The Global North, in particular its polluting corporate actors that have contributed most to emissions, have a duty to pay for these losses and damages.28 In the words of academic Dr Keston Perry, these transfers ‘must aim to remove the label and associated ideas of ‘charity’ from climate funding within the loss and damage category and promote reparatory justice.’29 This $200–300 billion per year estimate, which is cited in Perry’s case for climate reparations, should be seen as the start, rather than the end, of the amount of climate reparations to be paid.

Proposals to pay for the pandemic and a Just Transition

Annual global revenues from 10 progressive proposals over the next decade

(in $billions / year):

Taxing the rich: global wealth tax

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.”

– Warren Buffett, Third Richest Person in the World

Why should we tax the rich? Private wealth is extremely unequally distributed. The world’s richest 1% have more than twice as much wealth as 6.9 billion people – 88% of the world’s population.30 Wealth is also massively under-taxed, with only 4 cents in every dollar of tax revenues coming from taxes on wealth. Furthermore, wealth concentration is built upon a patriarichal and racist economic system, shown by the fact that the world’s richest 22 richest men on the planet collectively have more wealth than all the women in Africa. And to make matters worse, those at the top participate in a global system of tax avoidance, hiding trillions in tax havens that cost governments billions each year – resources that could be used to fight the pandemic and the climate crisis.

COVID-19 is exacerbating wealth inequality.31 In July this year, as the virus swept throughout the world, billionaire wealth hit an all-time record high.32 To put this into perspective, consider the CEO of Amazon and the world’s richest man, Jeff Bezos. If he gave every single employee of Amazon a $105,000 bonus, he would still have more wealth than at the beginning of the pandemic.33

Income Total: $4.417 trillion

Proposal One:

A global wealth tax could raise $4.417 trillion a year.

This estimate is based on the global wealth tax proposal from Thomas Piketty in his latest book Capital and Ideology.34 The wealth tax is highly progressive, with the richest segments of elites paying much higher rates than the rest of society.35 A successful wealth tax would quickly shrink the fortunes of the rich, reducing the revenue raised over time. The $4.417 trillion a year estimate already takes this into account, as it assumes that the top 1% wealthiest households on average see their share of wealth reduce from 20% to 10% due to the tax.

Implementing a global wealth tax will have to overcome several obstacles. Firstly, as there is currently no global tax collector, consensus would need to be reached between governments to implement the same progressive wealth tax at the national level and redistribute the revenues globally. Secondly, the high tax rates on the very rich would undoubtedly inspire a fierce backlash from a global elite, unwilling to see their fortunes redistributed, which could stall and dilute demands for tax progressivity. The $4.417 trillion total is, therefore, an illustration of the orders of magnitude of potential revenues, rather than an exact figure that can be collected immediately. However, with the right ideas, timing and political will, quick shifts are possible. Take the history of the progressive wealth tax itself: five years ago it was an idea on the margins of society. Today, many countries are seriously thinking about implementing it.36

1a. A billionaire wealth tax could raise $70 billion37 to $100 billion a year38

A quicker proposal to implement, and one advocated for by Oxfam, would be to just tax all fortunes over a billion dollars at a small rate of 1.5%.39 The tax would only impact billionaires, who hold 2.7% of the world’s wealth and make up only 0.00002% of the world’s population. In 2019, the world’s billionaires, only 2,153 people, had more wealth than the poorest 4.6 billion people combined.40

1b. A millionaire wealth tax could raise $1.159 trillion a year41

If we implemented a 1% tax rate on all net wealth over a million dollars, we could raise well over a trillion dollars a year. If the rate was raised to 5%, $5.795 trillion could be raised. Some millionaires are even asking to be taxed at a higher rate!42

1c. A tax on the wealthiest 1% in each country could raise $418 billion a year43

A very small tax rate of 0.5% on the net wealth of the richest 1% in each country could raise nearly half a trillion each year. See the report by Oxfam to understand how this $418 billion is broken down per region in the world.44

CASE STUDY: USA

Given the big debates on wealth taxes during the Democratic primaries this year, the USA has some of the most developed ideas on wealth taxes. Both Bernie Sanders and Elizabeth Warren put forward different proposals that would require elites to pay small rates (1–2%) on any wealth they owned over a high threshold (around $32–50 million). The estimated revenues generated over the next 10 years from such a tax are in the region of $1.4 to $4.5 trillion.45

CASE STUDY: South Africa

Consensus for a new wealth tax in South Africa is building, with the Davies Tax Committee recently releasing a report on the issue. In South Africa, wealth is extremely concentrated: the top 10% own 86% of wealth; the top 0.1% own almost one third.46

A new tax would face several issues: enforcing exit taxes that disincentivise expatriation and capital flight; providing payment options where wealth can’t be immediately turned into cash to pay taxes and including taxpayers’ offshore wealth. Given that nearly 30% of South Africa’s wealth is held offshore, like many countries in the Global South, this last issue is crucial to make sure the tax is effective.47

Income Total: $4.542 trillion

Proposal Two:

Taxing the capital income from offshore private wealth could raise $125 billion a year.48

Estimates of private offshore wealth range from $7.6 trillion to $32 trillion.49 It is predominantly the richest people in the world that hide their wealth offshore.50 The $125 billion estimate comes from taxing, at current rates, the income that flows from wealth hidden offshore. It is therefore not a policy to implement a new tax, but to close down the opportunities for the rich to hide their wealth offshore.

This policy could be implemented alongside Piketty’s global wealth tax, as the extra revenues from shutting down tax havens come from income generated by wealth rather than on the stock of wealth itself. Furthermore, in order to implement both policies, campaigners are pushing for a global asset register that records who is holding which assets, shared by all countries across the world.51 A global asset register would particularly benefit the Global South, shutting down potential illicit financial capital flows from plutocrats hiding their assets in the Global North.

FURTHER RESOURCES

See here for specific EU, UK (proposal 1 and 2) and Indian wealth tax proposals.

Taxing Big Corporations: from pandemic profiteers to treasure islands

“Nobody in the world, nobody in history, has ever gotten their freedom by appealing to the moral sense of the people who were oppressing them.”

– Assata Shakur

Alongside rich individuals, many of the biggest corporations are profiting from the pandemic. To stop the post-COVID world concentrating corporate power even further while imposing austerity for the rest, the profits locked up in the world’s biggest and most powerful corporations must be redistributed.52 The wealthiest 10% of Americans now own 89% of all stocks, while the bottom 50% of Americans don’t own even 1% of company equities.53

This section looks at three policies to redistribute this income: an excess profits tax on COVID-19 profits (taking inspiration from the similar policies implemented by governments after the first and second world war); clamping down on corporate profit shifting and tax avoidance; and a global financial transaction tax to redistribute the public money currently flooding the world’s banking system.

Income Total: $4.646 trillion

Proposal Three:

An excess profits tax on the 32 most profitable global companies would raise $104 billion a year.54

Excess COVID-19 profits are the profits a company makes during the pandemic above and beyond the average of the last four years (2016–19). While the pandemic has forced millions into poverty, Microsoft, Apple, Google, Nestle, Amazon are making billions more than they would have done if the disease had never spread. Oxfam have put forward a proposal to tax these profits at a rate of 95%, which would raise $104 billion a year.55

How feasible is an excess profits tax? Both the US and Britain imposed excess corporate profit taxes after the First and Second World War at rates of 80% and 95%.56 Two leading law researchers at McGill University argue that such a tax is entirely feasible within the current OECD framework, setting out their proposal in a recent paper.57 The $104 billion a year estimate is also only based on the top 32 most profitable companies – the total global estimate would be much, much higher.

CASE STUDY: Taxing the Tech Titans in Indonesia

Some countries have unilaterally tried to implement taxes in the spirit of an excess profits tax. One example of this has been Indonesia’s new tax on tech giants. In order to deal with the economic effects of COVID-19, Indonesia has proposed implementing a new sales tax on digital goods and services. Big international tech companies that have profited from the pandemic, such as Zoom and Netflix, make a significant amount of their revenue in the country, but do not pay tax as they have no physical presence there.58 There is also support from the G-24 and the EU for a digital services tax.59

Income Total: $5.246 trillion

Corporations shift a huge amount of their profits to tax havens each year, costing governments billions in lost revenues. This $200–$600 billion estimate is the amount that could be raised if opportunities for profit shifting to tax havens were shut down, and corporations were taxed in the country where they employ workers and sell their products. You can track where these missing profits are using this map. Profit shifting by corporations makes up a large part of the illicit financial flows that flow from the Global South each year, where each year a net $3 trillion flows out of the Global South and into the Global North.61

One mechanism to stop corporate profit shifting is to set a minimum corporate tax rate across all countries. The revenues from such a global minimum corporate tax obviously depends on the rate set. The OECD is currently proposing a low rate of 12.5%, which they argue would raise an extra $100 billion a year.62 Given the low rate, this would only increase tax rates in a small number of offshore tax havens, as most countries already have rates above this threshold.

The OECD proposal fails to account for the race to the bottom in corporate tax rates across all countries, and not just in tax havens.63 Raising minimum corporate tax rates to 28% just on US multinational corporations,64 would raise $758 billion over the period 2021–2030.65 To put this 28% rate into perspective, this is still well below the global average corporate tax rate in 1980, which was 40.38%.66

Furthermore, the OECD proposal fails to provide adequate revenues for countries in the Global South,67 with many civil society groups criticising the proposals as predominately favouring OECD countries.68 Reforming global corporate taxation should be managed by an institution which represents countries in the Global South. As the saying goes, ‘if you are not on the table, you are on the menu’.

Income Total: $5.6648 trillion

A financial transaction tax raises money by implementing a small rate on the trading of stocks, bonds and derivatives. The rates for this estimate come from the proposal put forward in 2011 to implement a financial transaction tax in the European Union by civil society, dubbed the “Robin Hood tax” (0.1% on the trading of stocks and bonds instruments and 0.01% on transactions of derivatives). Despite the low rates pushed for by campaigners, and in spite of some initial support from several EU governments, the tax has not yet been implemented due to heavy lobbying by the financial sector.70 See the reference for more information on the proposal put forward by civil society.71

FURTHER RESOURCES

Resource on how corporate tax rates have declined around the world

Fossil Fuel Dividend

“You’ve all heard that ‘our house is on fire’. But for many of us, our house has been on fire for over 500 years. And it did not set itself on fire. We did not get here by a sequence of small missteps and mistakes. We were thrust here by powerful forces that drove the unequal distribution of resources and the rigged structure of our societies.”

– Wretched of the Earth Collective, London

Since the UN set up the International Panel on Climate Change (IPCC) in 1988, the world has emitted more carbon than in all the centuries and millennium before it. Yet, the responsibilities and costs of these emissions do not fall on us equally. On the production side, more than half of global industrial greenhouse gases (GHGs) can be traced to just 25 profitable corporate and state producers.72 On the consumption side, half of these emissions came from the world’s richest 10% of people.73

Despite being the least responsible for the crisis,74 the Global South suffers more than 90% of the costs, and 98% of the deaths associated with climate breakdown.75 Climate change is expected to displace 50 million to 300 million people by 2050, with women making up 80% of those already displaced.76 In the words of the former UN Special Rapporteur Philip Alston, this is ‘climate apartheid’.77

To fight the climate emergency, these colonial and class based inequalities must be tackled. The figures below highlight the funds that can be raised by taxing pollution and eliminating subsidies for the fossil fuel industry. There are some caveats to these figures. Eliminating subsidies and raising carbon taxes are not a mea culpa for the climate crisis. We cannot simply price in the negative externalities and allow the market to transform us towards a green future. More systemic and fundamental reform is needed.

As the Gilet Jaune protests in France and the 2019 protests in Ecuador78 show us, eliminating public subsidies to fossil fuels and taxing carbon, if not properly designed, can also end up hitting the poorest households the hardest.79 Reforming subsidies and implementing fossil fuel taxes must therefore be done alongside building publicly owned democratically organised renewable energy systems as well as providing sufficient social welfare so that rising energy prices do not leave the poor worse off.

With these caveats, these figures show the potential revenues that can be raised by radically altering our energy system. As the richest 20 percent of households receive six times more in subsidies than the poorest 20 percent,80 it is clear that the current system does not protect the interests of the poorest in our society.

Income Total: $8.8648 trillion

Proposal Six:

Eliminating public subsidies to the fossil fuel industry and implementing a tax on the cost of pollution could raise an extra $3.2 trillion a year.81

Governments currently subsidises fossil fuels to the tune of $296–$478 billion a year.82 The $3.2 trillion a year figure includes both an estimate of redirecting those $296–$478 direct subsidies in addition to implementing a tax on carbon.

CASE STUDY: Is it possible to reform fossil fuel subsidies?

To have any chance of minimising the most dangerous climate change impacts, we need to keep fossil fuels in the ground. A wide range of international organizations (G20, G7, European Union and Asia-Pacific Economic Cooperation) support removing subsidies on fossil fuels. In the words of the OECD, we should “seize the opportunity of historically low oil prices to redirect some of the half a trillion dollars spent annually supporting fossil fuels into sustainable investments including low-carbon energy”.83 Indonesia has successfully reformed gasoline and diesel subsidies in 2015, saving $15.6 billion – over 10 per cent of state expenditure. These savings were reallocated to fund a wide range of economic development and infrastructure investments.84

CASE STUDY: Carbon Damages Tax

While there are many examples of fossil fuel taxes and important concerns about whether they are the best tool for delivering a just climate transition, one of the more comprehensive and progressive proposals is known as The Climate Damages Tax (CDT). CDT makes the polluter pay, charging a levy on the extraction of each tonne of coal, barrel of oil, or cubic litre of gas, based on how much climate pollution (CO2e) is embedded within the fossil fuel. The revenues from the CDT would be paid into the already existing United Nations’ Green Climate Fund, with richer countries paying more relative to their historical emissions and capacity to pay. The rate of tax increases each year, incentivising the phasing out of fossil fuels by the middle of the century. The researchers recommend that the CDT is introduced in 2021 at a low initial rate of $5 per tonne of CO2e, increasing by $5 per tonne each year until 2030 to $50 a tonne.85

Welfare not Warfare

“The world is over-armed and peace is under-funded.”

– UN Secretary General Ban Ki-moon

Dealing with the pandemic has often been dressed up in the analogy of war, from essential workers ‘on the front line’ to dubbing the virus ‘the invisible enemy’. Yet COVID-19 has exposed how the real threats to humanity – climate change, inequality and pandemics – cannot be tamed through the barrel of a gun. With the amount pumped into global military spending each year, we could fund 413 more World Health Organisations.86

Buying more soldiers, jets, tanks and aircraft carriers does not just cost us fewer doctors, ambulances and hospitals. It also costs us in more wars, corruption, militarised borders and humanitarian crises. Take the US military as an example. While it is responsible for 38% of the total global military spending, in the words of campaign group Win Without War, it “can’t spend the money it already has, can’t pass an audit, and almost half of its annual budget goes to major arms companies.”87 Since the beginning of the war on terror in 2001, the US military has contributed to displacing an estimated 37 million people – the equivalent to the entire population of Canada.88

Income Total: $9.0565 trillion

Proposal Seven:

Reclaiming 10% of global military spending could raise $191.7 billion a year globally.89

Global military spending in 2019 was $1917 billion.90 A 10% reallocation of military spending has been called for by The Global Campaign on Military Spending91; US Senator Bernie Sanders92 and Code Pink.93 The general principle of humanitarian disarmament for COVID-19 has been supported by more than 250 organisations across the world.94 South Korea has said that it will trim next year’s defence budget by 2% ($738m) and Thailand by 8% ($557m), with the money going instead to a disaster-relief fund and stimulus package respectively.95

CASE STUDY: USA

Of the $1,917 billion (1.9 trillion) spent each year worldwide on the military, $732 billion (38%) is spent by just one country: the USA. As reported by Win Without War, “in its initial response to the crisis, the Trump administration requested a $2.5 billion budget supplemental to combat the corona virus – almost exactly as much as the Pentagon spent on the newest model of aircraft carrier… in cost coverages alone.” While the global coordination of reducing military expenditure is complicated, unilateral action by the US alone, along similar lines to Thailand, would make a huge difference.

Reclaiming Economic and Monetary Sovereignty

“There’s no better way to justify relations founded on violence, to make such relations seem moral, than by reframing them in the language of debt – above all, because it immediately makes it seem that it’s the victim who’s doing something wrong.”

– David Graeber

Given the long history of colonial exploitation and structural adjustment programmes gutting public budgets in the Global South, countries face three key immediate funding problems.

- The COVID-19 crisis hit at point when the Global South already had historically record high debt levels. Shockingly, sixty-four countries currently pay more on debt servicing than on health care.96

- Huge capital outflows have frozen the Global South’s already limited ability to service these debts. In March 2020 alone, more than $100 billion exited from emerging markets: the largest ever on record.97

- The lack of monetary tools and resources (stable currencies, dollar reserves, access to central bank swap lines, tax base) and high inflation have prevented these countries mobilising the same unprecedented levels of state support that has been seen in the Global North. Even the president of the World Bank called the international debt system, “the modern equivalent of debtor’s prison”.98

This section looks at three international policies needed to reclaim economic and monetary sovereignty in the Global South99: debt cancellation, special drawing rights and grants. These policies are best understood as a redistribution from the Global North to the Global South – and only a first step towards addressing the systemic inequality put in place since colonial rule.100

Income Total: $9.1565 trillion

Proposal Eight:

A debt jubilee could free up the equivalent of $100 billion a year for the Global South over the next ten years.101

At the beginning of the pandemic, UNCTAD called for a debt jubilee of $1 trillion.102 Global total debt has reached a peak of $258 trillion in 2019 (331% of GDP).103 In 63 impoverished countries, the average government external debt payments rose from 5.5% (as part of government revenue) in 2011 up to 12.4% in 2019, and are estimated to rise starkly in the coming years. More than 30 countries currently face a default on international debt payments.104

When countries face high debts they can either: (i) increase their ability to pay debt; (ii) print money to pay back the debt and reduce its value in real terms; (iii) reduce their debt burden. Due to the huge outflow of money (i) is a massive challenge, without increasing export income or reducing public spending on essential services. Inflation (ii) is also not an option for many Global South countries with already high rates or with debts dominated in external foreign currencies. The main path left is therefore to reduce their debt burdens by cancelling or postponing repayments.

When it comes to debt cancellation what has already been promised? The IMF in April announced a debt relief of approximately $214 million to 25 of the world’s poorest countries105 and the G20 agreed on a bilateral debt repayments moratorium for low-income countries until the end of 2020. However, as campaigners have argued, a halt to debt servicing is not the same as a debt cancellation. And in total, this relief only amounts to $20 billion, a negligible decrease given that the Global South is estimated to pay $3.9 trillion of debt service this year.106 Furthermore, debt cancellations or delays often come with conditionalities from creditors, that force debtors to reduce public spending and ultimately leads to an increase poverty. Over 500 organisations and academics from 87 countries have signed a letter urging the IMF to stop promoting austerity as a condition for bailouts and lending.107

CASE STUDY: CAPITAL CONTROLS

Another way to prevent debt crises in the Global South is for indebted countries to implement capital controls. When targeted at certain capital flows that exacerbate systemic risks, such as the huge outflows since COVID-19 from the Global South, capital controls can be useful tools for preventing or mitigating financial and social crises of various kinds. Some concrete examples of capital controls can be seen in the reference below.108 Furthermore, the video cited has a good background on the potential role of capital controls in the Global South.109 Capital controls would however require the WTO, IMF and other governmental institutions to allow indebted countries to install them – something they historically have fiercely opposed.

Income Total: $9.4065 trillion

Proposal Nine:

A new issuance of Special Drawing Rights could free up the equivalent of $250 billion a year.110

Progressive International are calling for $2.5 trillion worth of Special Drawing Rights to be issued.111 Special drawing rights (SDRs) are the IMF’s own international “currency”. SDRs are safe assets whose value is determined by a multi-polar basket of currencies. Countries can exchange SDRs for currencies, thereby giving countries that lack foreign reserves a lifeline of international liquidity during a crisis. Issuing SDRs can best be compared to monetary financing in the sense that the IMF gives countries new money without any expectation to repay. States thus acquire money and do not take on more debt. SDRs also do not come with punishing conditionality agreements, like current IMF loans.112

How much could be issued in SDRs? In theory, there is no limit to how many SDRs can be issued, as they can be created at the click of a computer button. Under the current allocation system, SDRs are distributed according to voting power at the IMF, which is unjustly taken by the richest countries in the world.113 For example, if $4 trillion worth of SDRs were created, only $250 billion would reach African countries.114 While rich countries, who already have access to international liquidity, could donate their remaining SDRs to countries that need them, this would not be guaranteed.

UNCTAD on the other hand put forward a proposal for $1 trillion worth of SDRs just for developing countries.115 This could be done by delinking, as a one-off allocation, SDRs from the quota system, as an exceptional measure. Reforming the IMF quota system has been suggested by Kristalina Georgieva, the Managing Director of IMF, although the USA, which has a super-veto, is currently blocking the proposal. In her words, “it isn’t off the table but we don’t have the 85% voting for it.”116

Income Total: $9.4565 trillion

Proposal Ten:

A new Marshall Plan could raise the equivalent of at least $50 billion a year for the Global South.117

At the beginning of the pandemic, UNCTAD called for a Marshall Plan of $500 billion support for Official Development Aid (ODA) receiving countries, largely in the form of grants.118 Paying for the pandemic and a just transition will require both redistributing resources from the private sector to the public sector (as the policies above largely do) and redistributing resources within the public sector from the Global North to the Global South. This Marshall plan in the form of grants takes this latter approach.

How will this be funded? One proposal is that the money for these grants could be raised by central banks and development banks. This would help to retain funds in the public sphere, that could be reinvested for social projects in the future.

Being a ‘public’ bank is not the same as being ‘progressive’. There are however many examples to learn from where public institutions have been held democratically accountable. For example, Costa Rica’s Popular Bank (Banco Popular y de Desarrollo Comunal) is run by a workers assembly made up of 290 representatives drawn from 1.2m workers/savers, it places financial returns on a par with serving environmental and social goals and 50% of the people in its decision-making bodies are women.119 Furthermore, the European Investment Bank has agreed to end financing fossil fuel projects by 2021 after successful pressure from campaign groups, showing that with social struggle leading to the right accountability, public institutions can change.

CONCLUSION

Who will pay for the crisis? One of the defining legacies of COVID-19 will be the unprecedented state support it has unleashed in the Global North. Encapsulating the old saying, “there are decades where nothing happens, and there are weeks where decades happen”, COVID-19 has shown that political action can be mustered in a matter of weeks – if political leaders deem it necessary.

In this limited sense, the pandemic has already shifted the Overton window of what is considered economically feasible. However, it is not just progressives who are in this battle to shape the future. Just recently, the fossil fuel industry has used COVID-19 to derail the EU Green Deal, lobbying to win concessions for climate-damaging energy schemes, gain access to bailout funds, and weaken environmental standards.120 Moreover, the IMF, despite more progressive language, has been pushing countries facing new debt crises into packages that promote austerity.

Drawing similar conclusions to other proposals to pay for the pandemic and a just transition (such as the new Geneva Principles for a Global Green New Deal121), this report has set out 10 proposals to mobilise resources from those with the broadest shoulders. Through new taxes on wealth and corporate profits, reforming fossil fuel subsidies, taxing carbon, redirecting military spending, cancelling debt and issuing SDRs, the globe could raise over $9 trillion a year for the next ten years. Collectively we can afford to build a better future – so long as the rich and powerful are made to pay.

While this report has tried to be as practical as possible, outlining reforms that are possible within the existing system of capitalism, it is also important to remember that building new economic, political and cultural models that put care for human and planetary life above the pursuit of profit will require much more systemic thinking. As Thomas Sankara said, “You cannot carry out fundamental change without a certain amount of madness. In this case, it comes from nonconformity, the courage to turn your back on the old formulas, the courage to invent the future”.

Notes

- Source

- Some of the proposals can be added together, while others are breakdowns of each other. All the headline proposals with a number (1, 2 etc) can be added together, while those with a sub-numbering (1a, 1b) are alternative proposals within the same category that can’t be added together (for example, we can’t implement a global wealth tax on the top 1% and on millionaires, as this will tax the same group twice). The full methodology section is available at the end of the report.

- These six are focused on as there are clear aggregate monetary figures within the existing research to draw on.

- Source

- This is measured at the international poverty line of $1.90 per day (a rate that is already considered to be too low). For the World Bank Estimate, see this Source. For a critique of the international poverty line, see J Hickel (2017) The Divide: A brief guide to global inequality and its solutions

- Source

- Source

- See the methodology section for where this estimate comes from. The underlying data comes from IMF Fiscal measures database.

- See Box 1 of the IMF World Economic Outlook report for an overview of how these impact public finances.

- See methodology section for more details of this.

- Source

- Source

- Source

- The sources for this range of costs can be found in the methodology section below.

- Wildauer and Lietch (2020) How to boost the European Green Deal’s scale and ambition

- Source

- Source

- See methodology notes for an overview of these alternative estimates.

- Source

- Source

- Source

- See the methodology section for an overview of where these wide-ranging figures come from

- Thomas Craemer (2015) Estimating Slavery Reparations: Present Value Comparisons of Historical Multigenerational Reparations Policies

- See the methodology section for an overview of how these estimates are constructed.

- Source

- Source

- Richards, J-A. and Schalatek, L, Financing Loss and Damage: A look at governance and implementation options, Henirich Boell Stiftung, (16 May 2017), p.56.

- Source

- Source

- Source

- Source

- Source

- Source

- Source

- The richest 0.1% would pay an effective rate of 10%, the top 1% would pay 5%, the top 10% would pay 1% and the bottom 90% would pay 0.5% effective tax rates on the stock of wealth. This leads to an effective tax rate of 1.225% on total wealth.

- Source

- Source

- Source

- Source

- Source

- Action Aid (2016, pg.37)

- Source

- Source: Oxfam (2015) via Credit Suisse 2015 data

- See methodology section

- Source

- (Aroop Chatterjee, Léo Czajka and Amory Gethin, 2020).

- Source: Professor Ingrid Woolard, Stellenbosch University, South Africa (Davies Tax Committee)

- Taxing Across Borders, Zucman, 2014

- See methodology for sources of these estimates.

- Alstadsæter et al (2017) Tax Evasion and Inequality

- Source

- See TNI https://www.tni.org/en/stateofpower2020 for an overview of the state of corporate power before the pandemic hit.

- Source

- Source

- Oxfam (2020) report

- Shaxson (2020)

- Source

- Source

- Source

- See methodology section for an overview of these estimates.

- Jason Hickel, The Divide, 2017

- Source: OECD

- Source

- Source: (Clausing, Saez and Zucman, 2020)

- If we raised the minimum rate to 28%, this would raise $1137 million over period 2021-2030.

- Source

- Source

- Source

- Source: (Pekanov and Schratzenstaller, 2019)

- Source

- Source

- Paul Griffin. 2017. The Carbon Majors Database. CDP Carbon Majors Report 2017.

- Source

- This latest report by The Lancet argues that the Global North is responsible for 92% of emissions in excess of the planetary boundary

- Source

- Source

- Source

- Source

- Oscar Reyes, 2020

- Source

- IMF (2019)

- See methodology and sources section for an overview of the estimates of direct fossil fuel subsidies.

- OECD 2020

- Oscar Reyes, 2020

- Richards, J-A et al. (2018) The Climate Damages Tax: A guide to what it is and how it works

- Global military spending in 2019 was 1.82 trillion. The WHO budget of $4.4 billion.

- Source

- Source

- See methodology section for sources

- SIPRI

- Source

- Source

- Source

- Source

- Source: The Economist 2020

- Source

- Source (Although more recent data suggests inflows are recovering See: IIF Capital Flows Tracker – August 2020 Ongoing Recovery)

- Source

- mes-africa.org

- See methodology section for a discussion of the accounting behind this

- Source: UNCTAD, 2020

- In order to make this comparable with the yearly estimates in the other proposals, we assume this is equivalent to a yearly debt jubilee of $100 billion a year.

- Source

- Source

- Source

- Source

- Source

- Source

- Source

- In order to make $2.5 trillion special drawing draws issued today comparable with the yearly estimates in the other proposals, we assume this is equivalent to a yearly issuance of $250 billion a year to the global south over the next 10 years.

- Source: Progressive International

- Source

- Source

- David Adler and Andres Arauz

- Source, pg. 101

- Source

- Source: UNCTAD, 2020

- In order to make $500 billion in grants today comparable with the yearly estimates in the other proposals, we assume this is equivalent to a yearly issuance of $50 billion worth of grants a year to the global south over the next 10 years.

- Source

- Source

- Source

- Source

- Source

- (Rozenberg and Fay 2019)

- Thomas Craemer (2015) Estimating Slavery Reparations: Present Value Comparisons of Historical Multigenerational Reparations Policies

- Source

- Source

- Source

- Source

- Source

- Source

- Taxing Across Borders, Zucman, 2014

- Taxing Across Borders, Zucman, 2014

- Source

- Thanks to Didier Jacobs from Oxfam for clarifying this point.

- Source

- Source

- Oxfam (2020) report

- Source

- Source

- See methodology section for an overview of these estimates.

- Source

- Source: (Pekanov and Schratzenstaller, 2019)

- Source

- Source

- Source